DislikedI'm makin' myself upset here ... gotta stop (trying) to be so exact. Was off by 0.1 pips here, and miscalculated a buy limit based on spread, and missed out on 20 pips. Oh well - starting to look like the upthrust is being sold into on GU, although EU has made a new high.

Note to self: do 3 pips really matter in the scheme of things?Ignored

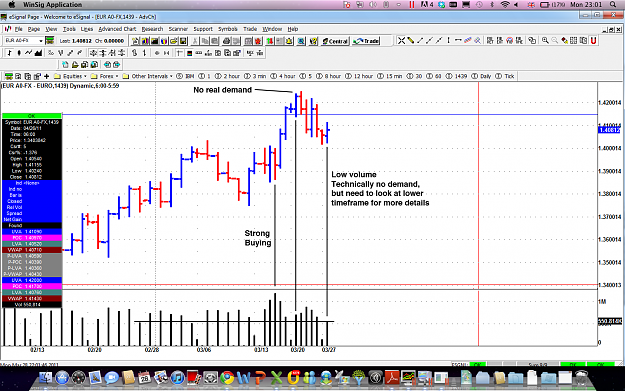

We upthrusted 20 pips after an almost bounce off the open, then came back down to retest it (to 1.60009 on my broker) and bounced a further enthusiastic 35+ pips.

I don't see anything on the M5 in that PA that is overwhelmingly obvious in terms of VSA, other than continued buying, defense and support at the day's (Sunday) open.

It is the bounce off that open that to me has the greatest meaning - if nothing else, 35 pips is nothing to sneeze at, in these wolf markets. It happens often, especially once PA is underway, in a significant session like London or NY. I find you can trade it with a tight SL (<5-10 pips), with a high risk-to-reward (ie., 25 pips minimum for TP1).

Be cautious though of sterling trades ... bad economic (growth) news is expected tomorrow.

Attached Image