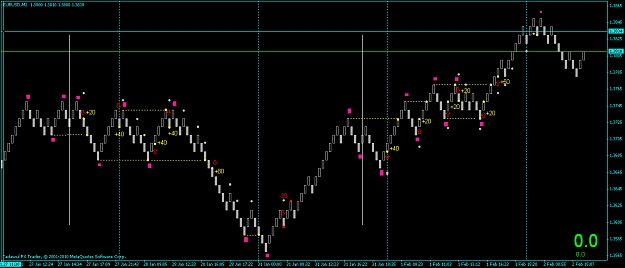

Thanks for posting John, always like it when coders show interest in making indis esp for renko chart traders.

You guys are too few & far between...!, I appreciate the effort...

Regards, 45

You guys are too few & far between...!, I appreciate the effort...

Regards, 45