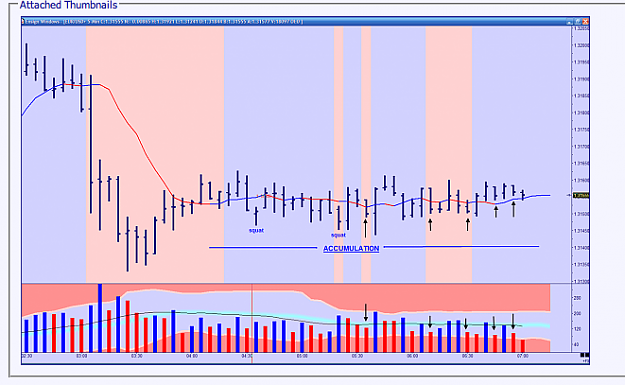

Greetings all, I have enjoyed checking in on this thread and my trading has defiantly improved as a result.

I was hoping somebody could help me out with HG's chart posted earlier today. I understand a squat to be a change of ownership bar, but I'm not 100% sure what the bars indicated with arrows are. Is this testing for supply?

- Post #8,102

- Quote

- Dec 21, 2010 3:50pm Dec 21, 2010 3:50pm

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone

- Post #8,103

- Quote

- Dec 21, 2010 4:07pm Dec 21, 2010 4:07pm

- | Membership Revoked | Joined May 2008 | 3,395 Posts

The Market pays you to be disciplined

- Post #8,104

- Quote

- Dec 21, 2010 4:24pm Dec 21, 2010 4:24pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #8,105

- Quote

- Dec 21, 2010 4:46pm Dec 21, 2010 4:46pm

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone

- Post #8,106

- Quote

- Dec 21, 2010 4:49pm Dec 21, 2010 4:49pm

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone

- Post #8,107

- Quote

- Dec 21, 2010 4:51pm Dec 21, 2010 4:51pm

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone

- Post #8,108

- Quote

- Dec 21, 2010 5:15pm Dec 21, 2010 5:15pm

- | Membership Revoked | Joined May 2008 | 3,395 Posts

The Market pays you to be disciplined

- Post #8,109

- Quote

- Edited 5:16am Dec 22, 2010 2:58am | Edited 5:16am

- Joined Feb 2009 | Status: Borderline yahoo & oh-no! | 6,607 Posts

- Post #8,112

- Quote

- Dec 22, 2010 9:48am Dec 22, 2010 9:48am

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone

- Post #8,113

- Quote

- Dec 22, 2010 10:15am Dec 22, 2010 10:15am

- | Joined May 2010 | Status: Day by Day | 1,004 Posts

Change is the only constant

- Post #8,114

- Quote

- Dec 22, 2010 10:19am Dec 22, 2010 10:19am

- Joined Apr 2007 | Status: HARD SHYT SCUBA TRADER | 20,883 Posts

Blogging daily now at www.volume.zone

- Post #8,115

- Quote

- Dec 22, 2010 12:01pm Dec 22, 2010 12:01pm

- | Joined May 2010 | Status: Day by Day | 1,004 Posts

Change is the only constant

- Post #8,118

- Quote

- Dec 22, 2010 12:26pm Dec 22, 2010 12:26pm

- Joined Dec 2009 | Status: Member | 2,367 Posts

- Post #8,119

- Quote

- Dec 22, 2010 12:32pm Dec 22, 2010 12:32pm

- Joined Dec 2009 | Status: Member | 2,367 Posts

- Post #8,120

- Quote

- Dec 22, 2010 12:39pm Dec 22, 2010 12:39pm

- Joined Dec 2009 | Status: Member | 2,367 Posts