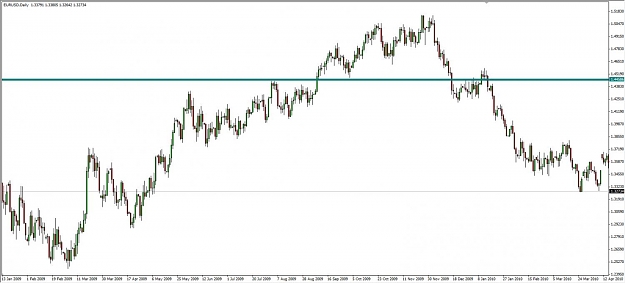

This is a Trend Following system in every respect. It is important to understand that you can see different Trends depending on what Timeframe you are looking at. I trade primarily the Daily and 4hr charts. I also have various ways of entering in the direction of the Trend, these vary from getting in during the early stages of the Trend to entering during pull backs in the Trend. This is why I titled this a complete guide. You should find everything in here that you need to make some money in this business.

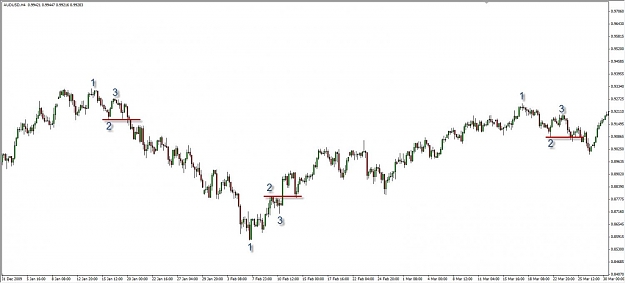

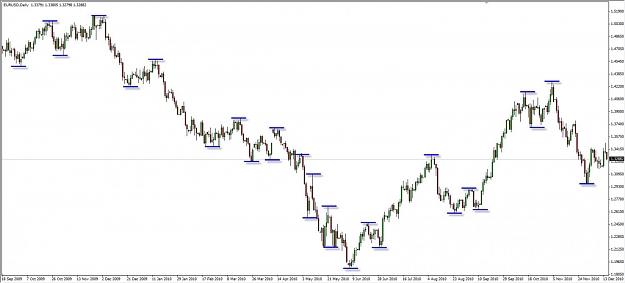

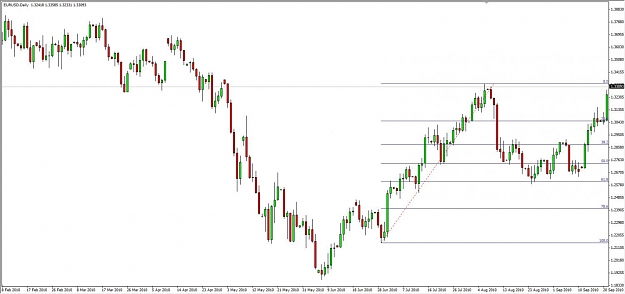

I don't have any specific pair that I like to trade, my only criteria is that the pair is indeed Trending. The only tools I really use are support and resistance, trend lines and fibonacci retracements.

Why share this you may ask? Why not? I spend countless hours in front of the screen everyday (I trade for a living) and it gets boring, so I figured why not speak to like minded individuals. I used to participate on this forum a lot more often than I do now and have learnt bits and pieces from other generous individuals so why not share myself.

I know and fully accept that there are many ways to make money in this business, mine is not the only one and I am certainly not the inventor of the wheel, I have just found what works for me. So there isn't really anything new in here, no holy grail, just a series of systems and approaches.

If you are going to follow this system you have to accept that we are looking for the home runs, the big trends that will make you extremely healthy returns, but to get there you will have to endure a few small losses and break even trades along the way.

We are Trend Followers, if you want to understand trend following better as a concept and philosophy you could read a great book by a guy named Michael Covel its called "Trend Following"

OK so let's get into the approach.

I don't have any specific pair that I like to trade, my only criteria is that the pair is indeed Trending. The only tools I really use are support and resistance, trend lines and fibonacci retracements.

Why share this you may ask? Why not? I spend countless hours in front of the screen everyday (I trade for a living) and it gets boring, so I figured why not speak to like minded individuals. I used to participate on this forum a lot more often than I do now and have learnt bits and pieces from other generous individuals so why not share myself.

I know and fully accept that there are many ways to make money in this business, mine is not the only one and I am certainly not the inventor of the wheel, I have just found what works for me. So there isn't really anything new in here, no holy grail, just a series of systems and approaches.

If you are going to follow this system you have to accept that we are looking for the home runs, the big trends that will make you extremely healthy returns, but to get there you will have to endure a few small losses and break even trades along the way.

We are Trend Followers, if you want to understand trend following better as a concept and philosophy you could read a great book by a guy named Michael Covel its called "Trend Following"

OK so let's get into the approach.