Hey guys

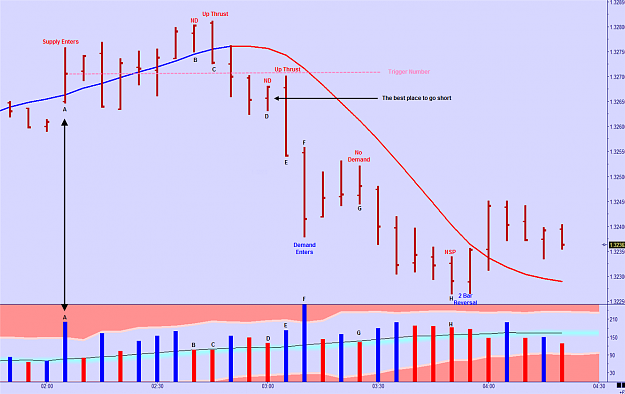

Hope some of you caught the short.

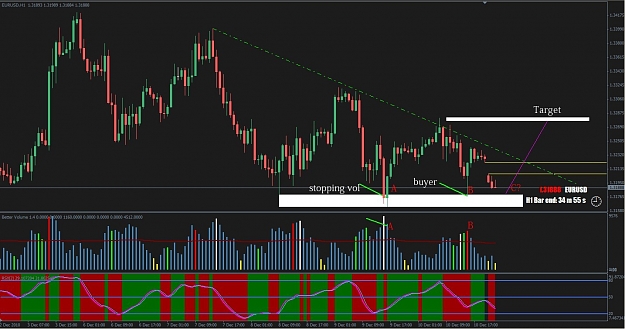

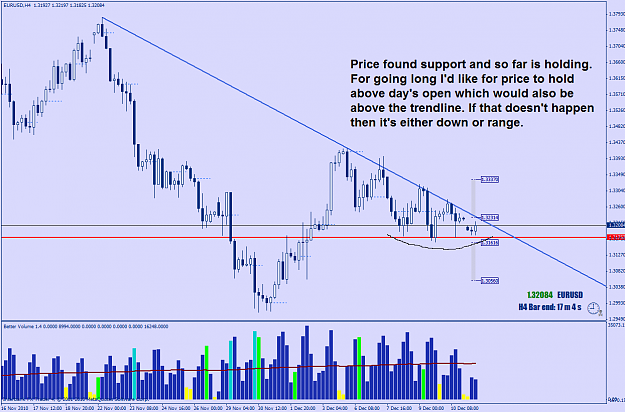

However on this chart ive wrote on the 6th of December, it looks like a real good test.

Also when price went back into that level it found strength, also if you go along this chart all the high volume bars looks like buying.

With the market ticking higher in Asia last night, and a resulting drop. Will have to wait and see if the strength comes in again.

So I see alot of strength in this chart, and will see what happens. One more thing lately its been easier to trade longer term charts, must be all traders are to busy browsing the web for Xmas gifts.

http://i865.photobucket.com/albums/a...te146/gu2h.jpg

Hope some of you caught the short.

However on this chart ive wrote on the 6th of December, it looks like a real good test.

Also when price went back into that level it found strength, also if you go along this chart all the high volume bars looks like buying.

With the market ticking higher in Asia last night, and a resulting drop. Will have to wait and see if the strength comes in again.

So I see alot of strength in this chart, and will see what happens. One more thing lately its been easier to trade longer term charts, must be all traders are to busy browsing the web for Xmas gifts.

http://i865.photobucket.com/albums/a...te146/gu2h.jpg