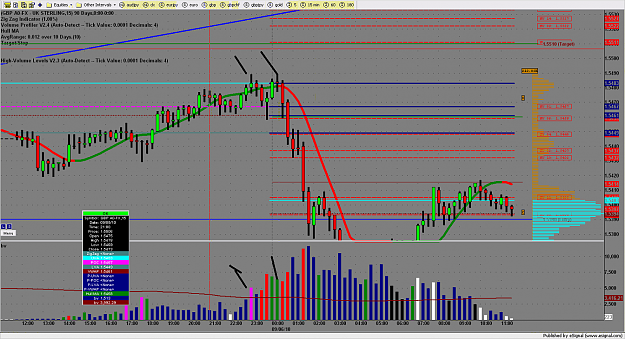

Hi all, Just a quick grab on GU trade

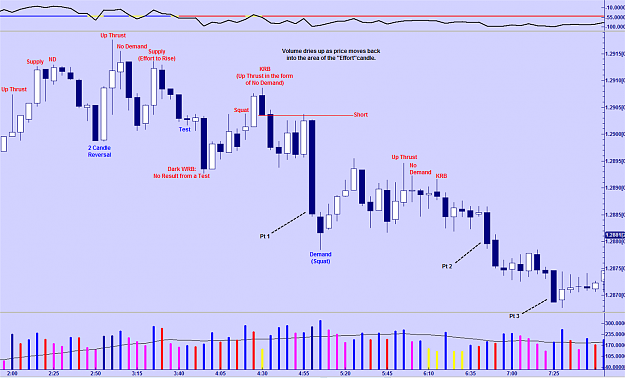

After the drop from London session, GU have provided a opportunity to counter trade the up move with the presence of climatic action & follow through. (Note how nicely the price bounce off fib extension at 261.8%.

PS: AR means "automatic reaction" usually occur after a strong climatic action when price bounces of the lows or after its high after a rally in which market will try to test the lows again, in this case.

Errata on the chart posted earlier where the "1st sign of weakness" was indicated. It should be strength.

After the drop from London session, GU have provided a opportunity to counter trade the up move with the presence of climatic action & follow through. (Note how nicely the price bounce off fib extension at 261.8%.

PS: AR means "automatic reaction" usually occur after a strong climatic action when price bounces of the lows or after its high after a rally in which market will try to test the lows again, in this case.

Errata on the chart posted earlier where the "1st sign of weakness" was indicated. It should be strength.