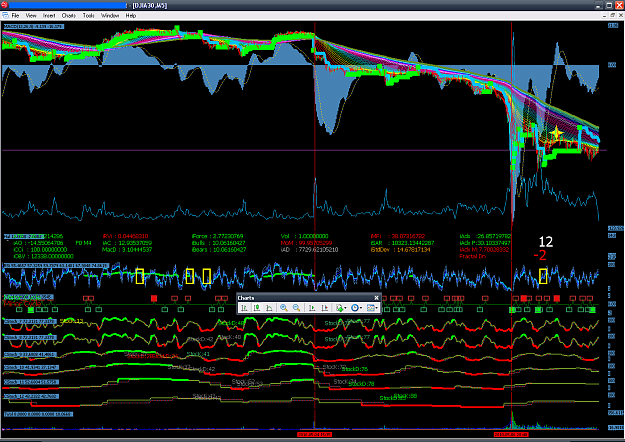

wow, what is all this nonsense. It was just a psych reaction to worries with Greece etc already fueling the downtrend.

All we needed was a major player to spark the move when the rest of the world is watching the move, and then they jump on the boat. There wasn't an error, as that wouldn't effect many instruments. YOU cannot move a 3 trillion dollar market a day with just an 'error'. Why I say 3 trillion? Because most currency pairs were shorted, especially the majors. Not just specifics.

In my honest opinion, the currency market drove the crash's that occurred in the equity markets rather than an 'error'.

Its supply and demand, and the currency market has a huge stake in the outcome of other markets. When a major player moves in an already downtrend market, people are already very psyched about the downtrend as it is, so they jump on more. The hell we care about the equity markets, as long as we short and we make money in the currency.

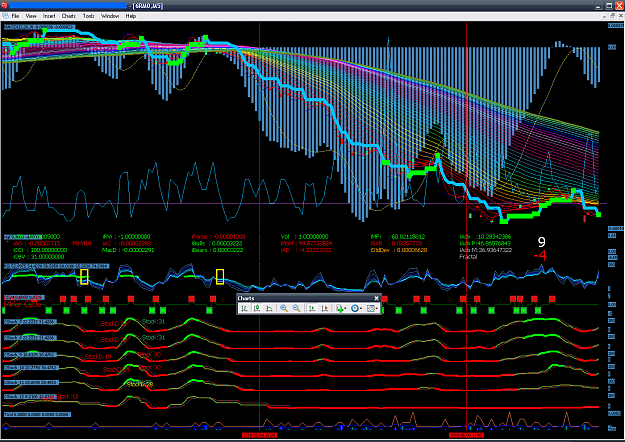

All we needed was a major player to spark the move when the rest of the world is watching the move, and then they jump on the boat. There wasn't an error, as that wouldn't effect many instruments. YOU cannot move a 3 trillion dollar market a day with just an 'error'. Why I say 3 trillion? Because most currency pairs were shorted, especially the majors. Not just specifics.

In my honest opinion, the currency market drove the crash's that occurred in the equity markets rather than an 'error'.

Its supply and demand, and the currency market has a huge stake in the outcome of other markets. When a major player moves in an already downtrend market, people are already very psyched about the downtrend as it is, so they jump on more. The hell we care about the equity markets, as long as we short and we make money in the currency.