Dear Teb, i like your system but maybe it would help people a lot more if you could show entries you take on both charts (5 min, 30 min) as i think pictures speak louder than words.

TEB : BB, Stoch & MACD- 15 & 60 min trading 21 replies

5EMA hilo system, and EA Idea 18 replies

TEB: 20 RSI and 5 & 12 EMAs 331 replies

RSI and TEB BBands Systems 84 replies

Please help code an EMA Crossover 12ema x 24 ema cross 1 reply

DislikedThanks Pgpb. What is yr TP and Sl on the 4 hr/ 1 hr tf? Is there any indicator that show the average ADR of the day? I am in at uj at 1.5352 and it seem like not going anywhere. ThanksIgnored

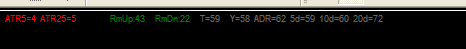

DislikedI use the attached ADR indicator....I got it from another thread on FF

As to SL and TP.....it is pretty much up to you....and something that requires your own discretion....I know that Teb talks about trading multiple lots.....taking profit on the first one quite early and letting the other run

IMHO this is a momentum stratagy.....if price goes in our direction it is going to go....so I like to keep stops relatively tight....but I also like to win larger than I lose......I have heard it said that money management is the Holy Grail of trading....something...Ignored

DislikedFYI TEB..

Using 5min/1min, 2 lots, and 10 pip SL, and using discretion only with respect to exit.. ie.. staying with 2 lots and not using 1 out at 10 etc., my results so far..

32 trades

27 wins

Net pips = 167.5

Most consecutive wins 9

I'm using 5/8 cross and both RSI's below or above 50.. that's it.

Excellent system TEB!!Ignored

DislikedHi pgpb, what does all the numbers and colors in the adr means? thank uIgnored

ATR (average trading range) of last 5 candles is higher than the ATR of the previous 25 candles, it simply

means that trading activity has increased.

If the ATR indicator is reading red (rather than green) it means the ATR of the last 5 candles is NOT greater than the previous 25 candles...which means trading activity is down. You could use this indicator as a method for deciding whether or not to jump in.

The indicator also shows how much room the currency pair has to move.

It calculates the average daily range....and if the pair has moved a lot in the day already....then it will show a very small (or negative it the pair has moved more than the daily range)

......BUT I caution you to get to excited about this....it is ONLY an indicator....price action is where it is at....reading bars and candles. (I do like the part that shows how much room the pair has to move...but I do not get too hung up on the ATR reading

(I have now exhausted my knowledge of this indicator )

DislikedSo you are entering mechanically, but using discretion / price action to exit?

Basically, the reverse of the entry/exit rules?Ignored

DislikedFYI TEB..

Using 5min/1min, 2 lots, and 10 pip SL, and using discretion only with respect to exit.. ie.. staying with 2 lots and not using 1 out at 10 etc., my results so far..

32 trades

27 wins

Net pips = 167.5

Most consecutive wins 9

I'm using 5/8 cross and both RSI's below or above 50.. that's it.

Excellent system TEB!!Ignored

DislikedYes David.

My experience trading various short term systems has not been good with respect to winning percentage or pips based on using money management techniques that take a lot off the table at 10 pips and allow the other to do what it is going to do etc.

Using a 5 min/1min TF, I have found that I can usually garner at least 5 pips per trade with about 75-80% accuracy consistently.

10-12 trades a day (NY session) with 2 lots nets me a decent return.Ignored

DislikedIf you set the ATR indicator to 5 and 25

[left]ATR (average trading range) of last 5 candles is higher than the ATR of the previous 25 candles, it simply[font=Times-Roman][size=3][color=#ff6600][font=Times-Roman]

[size=3][font=Times-Roman][color=#ff6600][color=#ff6600][size=3][font=Arial][size=4][color=black][size=3]means...Ignored