Quoting AntraDislikedYes James......have you checked your email?????

And Trey's thread????Ignored

One hour tunnel method 2 replies

Tunnel Vision. Independent Signals & Positioning Recommendations. 189 replies

4 hour tunnel confusion 8 replies

I am confused about all the different Tunnel methods out there...Clarificatio n please 3 replies

Questions re: MT4 and VWB 1 Hr Tunnel 0 replies

Quoting AntraDislikedYes James......have you checked your email?????

And Trey's thread????Ignored

Quoting firehorseDislikedHi,I'm floundering a bit here.

The original 4 hr tunnel should be profitable but I think I don't understand the rules properly because I cannot as yet duplicate the original results.

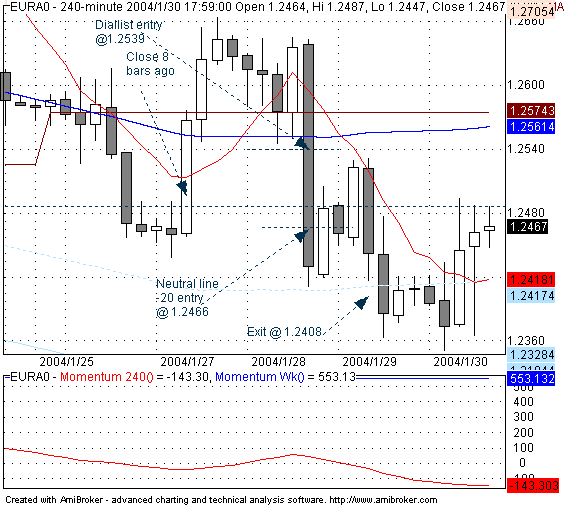

The new 20pip rule by Diallist seems even better but I can't seem to duplicate his results from the above post as yet. There's a misunderstanding somewhere.

The updated rules by vegas seems to be in development and there is nothing to compare against at the moment. I would prefer if I could understand the discrepancies above before moving onto another system along this theme.

Best regards

AlanIgnored

Quoting keris2112DislikedHi all,

I've been a member here for a while, but I don't think I've ever posted. I post a lot at other forums and just never quite got around to FF very often. Wow, was that a mistake. You guys are great.

Ignored

Quoting AntraDislikedHi Keris,

I too have been playing around with the vegas tunnel and trying to work out how to trade it in a more mechanical fashion.

I came across the HMA a few weeks ago and found it to be a pretty good little indicator. Seems to have very little lag.

The one I have been using is 'HMA in colour'.

It changes colour as the trend turns...but here is the problem.

I am not 100% sure that once the bar has finished that the colour will remain changed.

Anyone willing to test it?

I first thought of putting this indicator on the weekly chart in place of the 28ema that Vegas mentioned as it seemed ( to me) to be giving more direction.

Anyway this is the HMA in colour on a setting of 21Ignored

Quoting diallistDislikedWow Alan! Why is there so much difference in our charts? Could someone else compare their chart to mine and Alan's and let us know which one is right, if either? Thanks.

DialIgnored

Quoting lwoo034DislikedOne thing I would LIKE to try (but don't have the software to do as I don't believe there is a release for any of the free charting software I use) is to try the Jurik MA. JMA may be even better than HMA - has anyone got the facilities to check this?Ignored

Quoting keris2112Disliked

BTW, both JMA and HMA are good. HMA is a little faster and JMA is can be a little smoother.

Here's a pic showing the differences.

8 sma

25 hma

14 jma

25 jma

http://img353.imageshack.us/img353/9...ajma6mj.th.gifIgnored

Quoting volanDislikedSince 8/55 crosses are such an important part of the system I was wondering if you could add the 55 SMA to the chart so that it can be seen where they cross and how much of a difference there is between each line.Ignored

Quoting firehorseDisliked23/01/04 Diallist has a short trade where I calculate momentum appears to be up.

02/02/04 Program picks up an extra mechanical trade

09/02/04 Program picks up an extra mechanical trade

11/02/04 Diallist has entry on 2nd bar after change in MA 8 slope whereas mechanically, the program only enters on the first bar after change

20/02/04 Secondary trade, Diallist had full points

25/02/04 Secondary trade, Diallist had full points

01/03/04 Secondary trade, Diallist had full points. Also had an fib377 exit for a fib233 exit

09/03/04 Diallist had a trade but 4hr momentum by my calculation appears to be below 50Ignored

Quoting firehorseDislikedDivide 4838 by 3 to get the number of points per 'risk on trade' => 1612.6Ignored

Quoting volanDislikedSince 8/55 crosses are such an important part of the system I was wondering if you could add the 55 SMA to the chart so that it can be seen where they cross and how much of a difference there is between each line.Ignored

Quoting diallistDislikedUm, I'm curious as to why you think 8/55 crosses are an important part of the system. I've seen nothing in the original document that indicates crosses are used at all, much less being important. I think that is main beauty of the system is the lack of ma crosses.Ignored

Quoting diallistDislikedYou lost me here. Why are you dividing by three?

DialIgnored

Quoting keris2112DislikedI think Volan is referring to the position sizing aspect of the 8/55 cross. When the 8 crosses the 55 and turns, take a full position. When the 8 turns without having crossed the 55, take 1/2 position.Ignored

Quoting keris2112DislikedI was wondering the same thing, although the Vegas doc does suggest choosing a unit size and then trading 3 units (or 1 1/2). I think this is the wrong way of describing it, as it implies that you determine your position size and them multiply it by 3, thus, on each trade, risking 3 times what your money management method tells you to do. That's probably not what they meant, but that's kind of how it sounds.

I think we should do just the opposite. Determine our position size, based on whatever money management method we use, and then divide by 3 to determine how much to take off at each fib level. With trading platforms offering micro lots now (or any-size lots at oanda), this is easy to do. We don't have to trade in 3-lot (or mini lot) multiples.Ignored