so far no one answered my 3 questions, just a lot of generic opinions. Please address the issues I raised at the top of this page. Cheers.

Kiwi,

I'll be glad to answer:

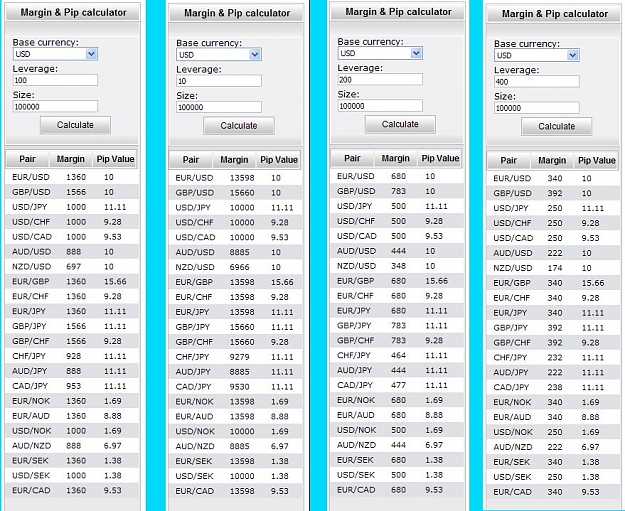

1). Yes, the margin on the 6E will increase under the proposed rule. If you're currently using 100:1 , then your margin will increase ten-fold.

2). No, the volatility of your position won't change ( at least so far the range in pips go, that's determined by the market)

3). The CFTC is taking public comments until March 22 , I believe. Of course, there will be congressional hearings on the proposed rule.

Someone asked who benefits from this. The answer is commodity futures brokers. The proposed rule is basically an attempt to move forex trading over to futures brokers like Lind-Waldock or Ira Epstein.

Kiwi,

I'll be glad to answer:

1). Yes, the margin on the 6E will increase under the proposed rule. If you're currently using 100:1 , then your margin will increase ten-fold.

2). No, the volatility of your position won't change ( at least so far the range in pips go, that's determined by the market)

3). The CFTC is taking public comments until March 22 , I believe. Of course, there will be congressional hearings on the proposed rule.

Someone asked who benefits from this. The answer is commodity futures brokers. The proposed rule is basically an attempt to move forex trading over to futures brokers like Lind-Waldock or Ira Epstein.