Hello Everyone,

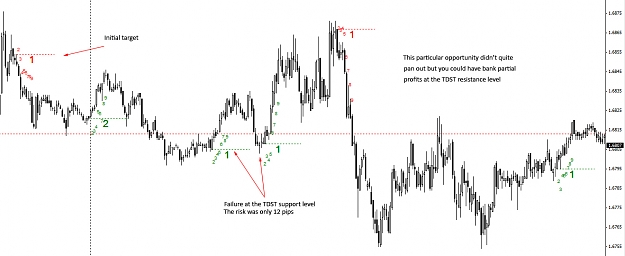

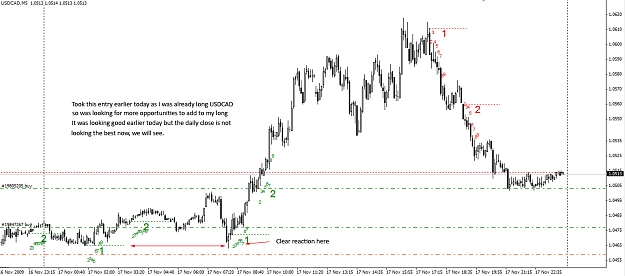

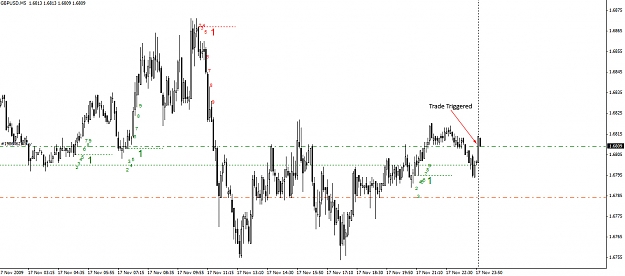

The reason I am starting this thread is because I thought it was about time we had a serious Demark trading thread. I have noticed several threads using the Demark method however to my surprise they have never taken off. The DeMark method offers opportunities on any timeframe or pair and can give risk as low as 12 pips for GBPUSD as was the case today on the 5 minute chart.

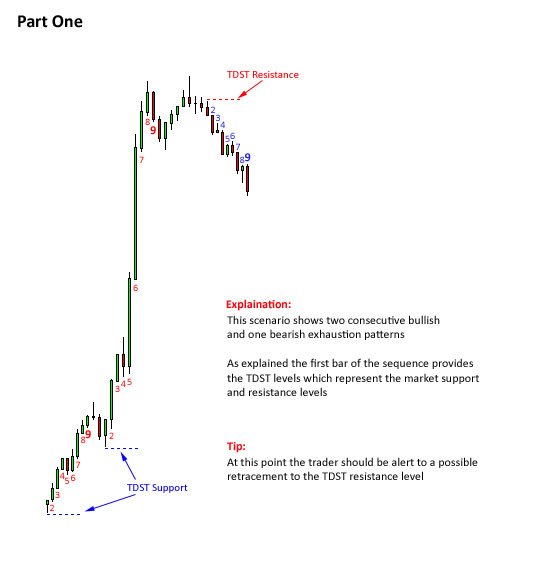

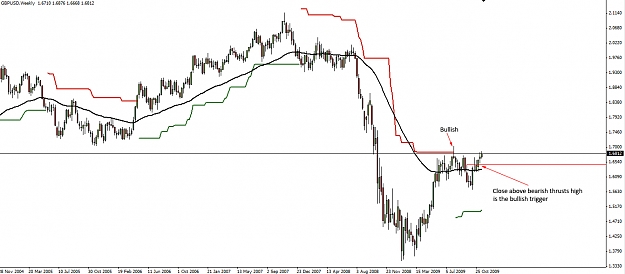

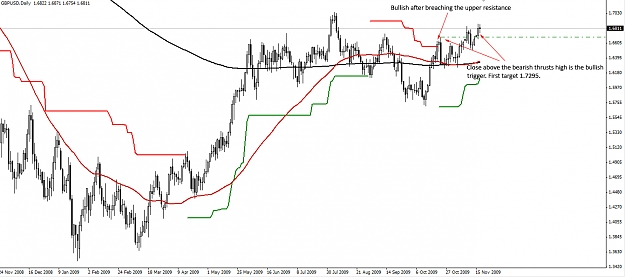

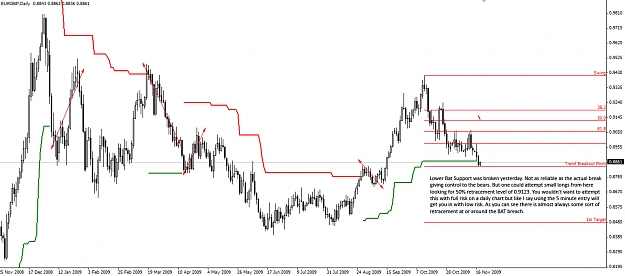

Going on past experiences I have found that using DeMark TDST setups works best when you have a longer-term view. For example, let say there was a daily bullish thrust on GBPUSD, the following day you would look to buy on a failure of a TDST support levels formed on a lower timeframe. I will try to also post my longer-term views and when I am looking for certain situations to develop. Please feel free to do the same.

Below is the rules on how I trade the DeMark Method, please just flip all of the below for a buy situation:

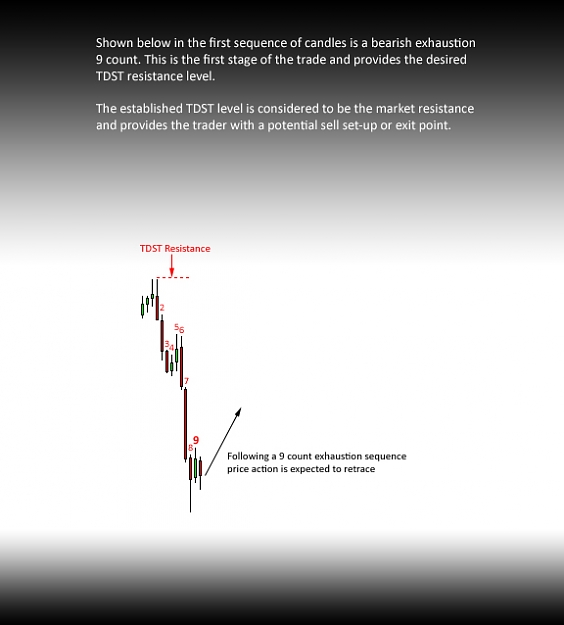

The formation of a 9 count downtrend exhaustion sequence and TDST resistance level

Step Two:

A retracement, touch and failure at the TDST resistance level*

Step Three:

Upon the closure of TDST resistance touch candle the chart will display the recommended number of lots

Step Four:

Press ctrl + S accordingly to open the number of lots specified**

Step Five:

a)Initial target should be placed at the closest TDST support level

b)If there is the formation of a 9 count downtrend exhaustion sequence the stoploss should be moved to the high of the 9th bar.

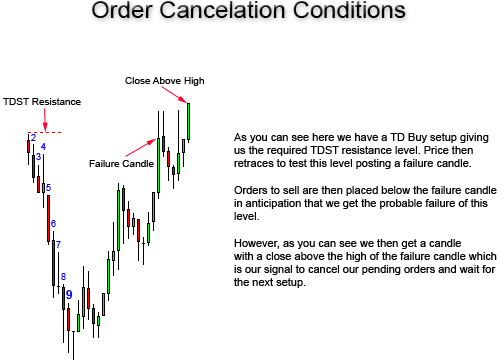

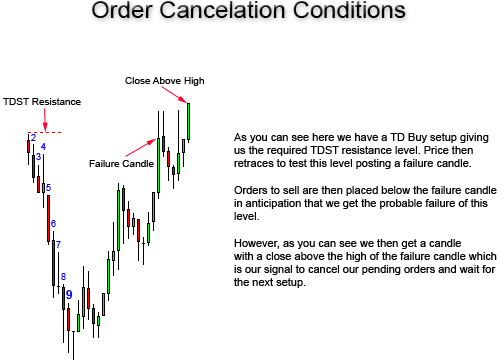

*Please note, once the touch candle has been established and orders have been placed they should only be cancelled if we get a close above the high of the touch candles high. Trades can be cancelled by using the TDCOUNT cancel script

**Please note, by pressing ctrl + S (you set the hotkey to whatever) the script will automatically calculate the entry and stoploss and open 0.1 lots per time and you will be shown how many lots you can risk on the right hand side of the chart. So you can just repeat until the desired number of lots have been placed

I have attached the indicators, scripts and my template file along with a picture of the perfect set-up and an order cancelation situation. In the next post I will post some more scenarios to help people understand it a bit more.

Please feel free to ask any questions, I am here to help.

Cheers

Foggytrader

The reason I am starting this thread is because I thought it was about time we had a serious Demark trading thread. I have noticed several threads using the Demark method however to my surprise they have never taken off. The DeMark method offers opportunities on any timeframe or pair and can give risk as low as 12 pips for GBPUSD as was the case today on the 5 minute chart.

Going on past experiences I have found that using DeMark TDST setups works best when you have a longer-term view. For example, let say there was a daily bullish thrust on GBPUSD, the following day you would look to buy on a failure of a TDST support levels formed on a lower timeframe. I will try to also post my longer-term views and when I am looking for certain situations to develop. Please feel free to do the same.

Below is the rules on how I trade the DeMark Method, please just flip all of the below for a buy situation:

TDST Bounce Sell Conditions

The formation of a 9 count downtrend exhaustion sequence and TDST resistance level

Step Two:

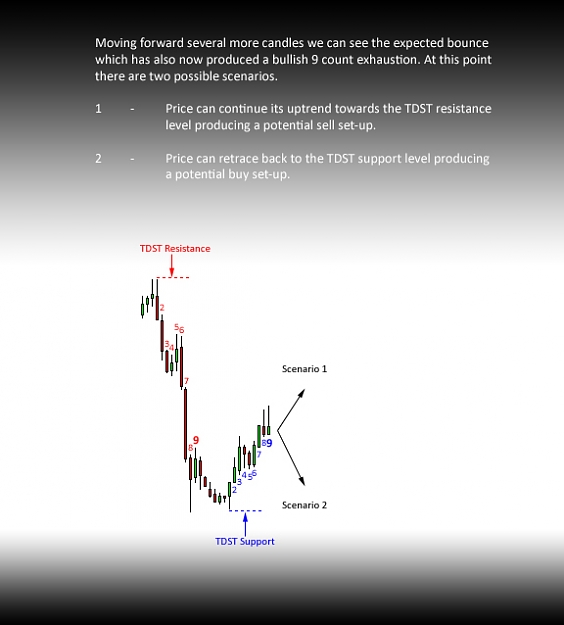

A retracement, touch and failure at the TDST resistance level*

Step Three:

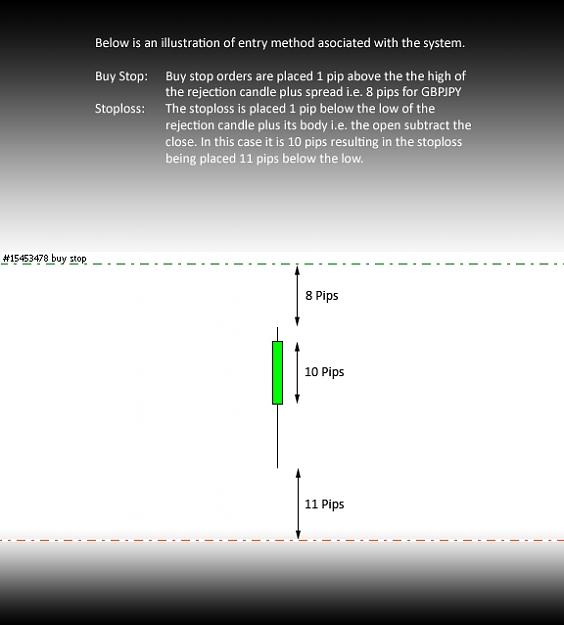

Upon the closure of TDST resistance touch candle the chart will display the recommended number of lots

Step Four:

Press ctrl + S accordingly to open the number of lots specified**

Step Five:

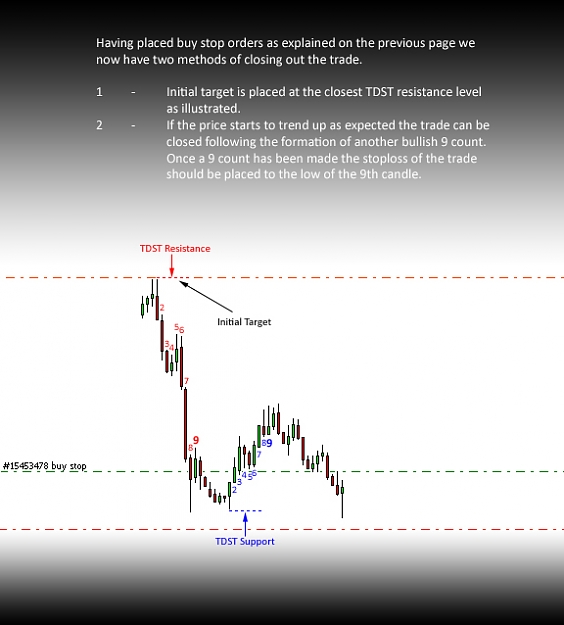

a)Initial target should be placed at the closest TDST support level

b)If there is the formation of a 9 count downtrend exhaustion sequence the stoploss should be moved to the high of the 9th bar.

*Please note, once the touch candle has been established and orders have been placed they should only be cancelled if we get a close above the high of the touch candles high. Trades can be cancelled by using the TDCOUNT cancel script

**Please note, by pressing ctrl + S (you set the hotkey to whatever) the script will automatically calculate the entry and stoploss and open 0.1 lots per time and you will be shown how many lots you can risk on the right hand side of the chart. So you can just repeat until the desired number of lots have been placed

I have attached the indicators, scripts and my template file along with a picture of the perfect set-up and an order cancelation situation. In the next post I will post some more scenarios to help people understand it a bit more.

Please feel free to ask any questions, I am here to help.

Cheers

Foggytrader

Attached Image

Attached File(s)