I think he is saying that every bar is unique and exists in a context. you need to pay attention of what is going on in the background. you cant take a bar in isolation and apply same description again and again. every time it is a different story, it is unique order flow every time.

in my opinion this is more into the area of order flow trading than vsa bar reading...

in my opinion this is more into the area of order flow trading than vsa bar reading...

DislikedHi Zoli,

that is from page 49 from T. W. Book - Undeclared market secrets.

This text could be in any page of Toms book... Such things in Toms books are a lot.

Here i attached this page.

Best,

TomIgnored

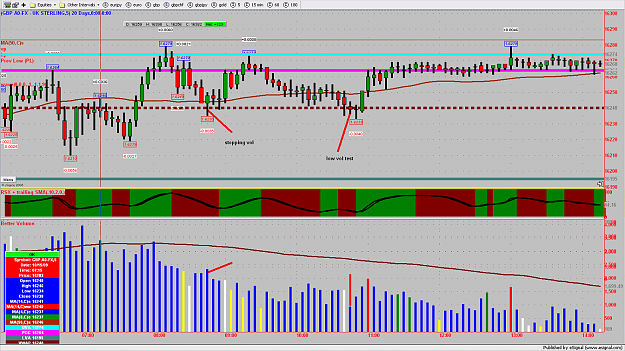

![Click to Enlarge

Name: 519463 FXDD - MetaTrader - [GBPUSD,M5].jpg

Size: 190 KB](/attachment/image/337876/thumbnail?d=1365588859)