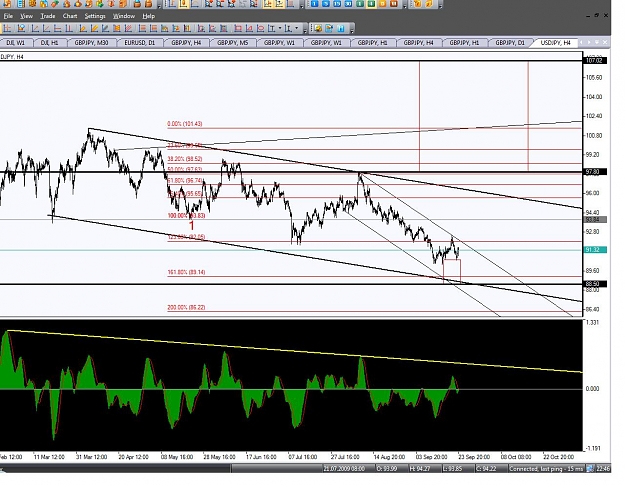

equity selloff helping the USD rebound here in an impulsive wave and this could be the much expected short-term buttom for usd ... regarding the usdjpy i stay away because i have no bias on the future moves...

- Post #199,542

- Quote

- Sep 23, 2009 4:33pm Sep 23, 2009 4:33pm

- Joined Aug 2008 | Status: Money never sleeps | 5,878 Posts

Markets are not Random, they are designed!

- Post #199,543

- Quote

- Sep 23, 2009 4:34pm Sep 23, 2009 4:34pm

- Joined Apr 2007 | Status: "As Above So Below" | 6,206 Posts

"Millionaires don't use astrology, billionaires do"

- Post #199,544

- Quote

- Sep 23, 2009 4:45pm Sep 23, 2009 4:45pm

- | Joined Apr 2009 | Status: Member | 522 Posts

- Post #199,545

- Quote

- Sep 23, 2009 4:47pm Sep 23, 2009 4:47pm

- Joined Aug 2008 | Status: Money never sleeps | 5,878 Posts

Markets are not Random, they are designed!

- Post #199,546

- Quote

- Sep 23, 2009 4:57pm Sep 23, 2009 4:57pm

- | Joined Apr 2009 | Status: Member | 522 Posts

- Post #199,548

- Quote

- Sep 23, 2009 5:07pm Sep 23, 2009 5:07pm

- | Joined Jun 2009 | Status: Member | 41 Posts

- Post #199,549

- Quote

- Sep 23, 2009 5:13pm Sep 23, 2009 5:13pm

- Joined Apr 2007 | Status: "As Above So Below" | 6,206 Posts

"Millionaires don't use astrology, billionaires do"

- Post #199,551

- Quote

- Sep 23, 2009 5:15pm Sep 23, 2009 5:15pm

- Joined Oct 2005 | Status: Member | 3,596 Posts

[

- Post #199,552

- Quote

- Sep 23, 2009 5:20pm Sep 23, 2009 5:20pm

- Joined Apr 2007 | Status: "As Above So Below" | 6,206 Posts

"Millionaires don't use astrology, billionaires do"

- Post #199,553

- Quote

- Sep 23, 2009 5:24pm Sep 23, 2009 5:24pm

- Joined Aug 2008 | Status: Money never sleeps | 5,878 Posts

Markets are not Random, they are designed!

- Post #199,555

- Quote

- Sep 23, 2009 5:35pm Sep 23, 2009 5:35pm

- | Joined Jun 2006 | Status: Trend is not my friend | 1,492 Posts

- Post #199,556

- Quote

- Sep 23, 2009 5:41pm Sep 23, 2009 5:41pm

- | Joined Oct 2008 | Status: Member | 1,666 Posts

- Post #199,557

- Quote

- Sep 23, 2009 5:46pm Sep 23, 2009 5:46pm

- Joined Apr 2007 | Status: "As Above So Below" | 6,206 Posts

"Millionaires don't use astrology, billionaires do"

- Post #199,559

- Quote

- Sep 23, 2009 6:06pm Sep 23, 2009 6:06pm

- | Joined Apr 2009 | Status: Member | 522 Posts

- Post #199,560

- Quote

- Sep 23, 2009 6:33pm Sep 23, 2009 6:33pm

- Joined Jul 2008 | Status: Invincible | 3,619 Posts