I'm starting this thread as a place to study and learn about Support and Resistance levels.

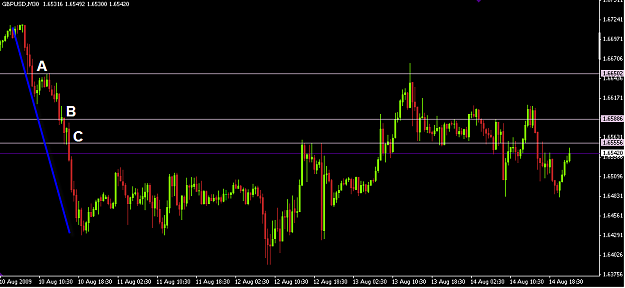

My trading style has been influenced by Wisdomfx and his power levels. While I don't completely understand how he comes up with his dead-on levels, I have noticed very interesting and very tradeable S/R levels.

These levels are either in conjunction with, or outside of, the obvious levels. If they match up with a previous turning point, it is a great signal that level is still strong and highly likely to be tradeable the next time price reaches it.

I invite anyone to share insights in how they find and trade S/R levels. I'd like this thread to be a place to share information. I use no indicators and would like this to be an indicator-free environment. There are tons of other great threads for that discussion.

There are tons of other great threads for that discussion.

It should be mentioned, as with Wisdomfx's method, I look to take 15-20 pips per trade.

My trading style has been influenced by Wisdomfx and his power levels. While I don't completely understand how he comes up with his dead-on levels, I have noticed very interesting and very tradeable S/R levels.

These levels are either in conjunction with, or outside of, the obvious levels. If they match up with a previous turning point, it is a great signal that level is still strong and highly likely to be tradeable the next time price reaches it.

I invite anyone to share insights in how they find and trade S/R levels. I'd like this thread to be a place to share information. I use no indicators and would like this to be an indicator-free environment.

It should be mentioned, as with Wisdomfx's method, I look to take 15-20 pips per trade.