((nicely done))

Correlation + Momentum Strategy? 6 replies

MT4 MTF Correlation table and Correlation oscillator indicators 155 replies

InsomiaFX Correlation Double Hedge EA 66 replies

Looking for EA for Correlation Strategy 6 replies

Hedge strategy (not a hedge fund) 13 replies

DislikedOk, then I'll apologize to everyone here for that "divergence". Maybe we can deal with what really matters....trading and learning. You're just as welcome here as anyone else as far as I'm concerned. It's 777's thread so if he feels it's taking away from the purpose of the thread then he'll say so and I hope everyone would ablige.

I didn't have much time to spend in front of the computer today so maybe I'll have time tonight/tomorrow.

Some interesting setups today though. The spread narrowed some on the U/C vs E/U. They've been running in...Ignored

DislikedI never said I trade these long/long or short/short. That's where you were incorrect. I said just the opposite and you still didn't get it. You just assumed that that's what we were doing because as you say "these pairs are usually traded long/long or short/short". Read and comprehend before you post something that basically insinuates that we're all a bunch of fools. We're exploring alternative ways to look at things. Things that may not "usually" be done. Oh damn, I just admitted to not being a conformist....Ignored

Disliked"These pairs are usually traded long/long or short/short..." Another interesting statistic is that 95% of traders fail. I wonder if there could be a correlation (no pun intended)?Ignored

DislikedAlthough I said I would not post here anymore, I will give you one more opinion of mine. Dreamliner's system of trading the gap is overlaying two charts of positively correlated pairs EURUSD and GBPUSD. When there is a gap he goes either short/long or long/short. That makes sense and that is "correlation and hedge" system, although he is just trading EURGBP. If you open 1 lot of each currency, then it goes in direction of EURGP but the pip difference is not equal to EURGBP move just because of the lot sizes used that do not cancel USD entirely,...Ignored

DislikedIgnored

DislikedHey JM, awesome indicators, great work. I have a stupid question though, what font are you using in your screen screen shots? When I load mine it uses the system one and some of the descriptions run over each other for the variance indi.Ignored

DislikedHi Lawrence,

do you realize how big risk you are taking ? Sell U/CH, Buy E/U ? have you checked history ? i dont want to scare you but you can easily finish in drawdown 2500 pips E/U and 2500 pips U/CH, so what would be profit loss ratio ?Ignored

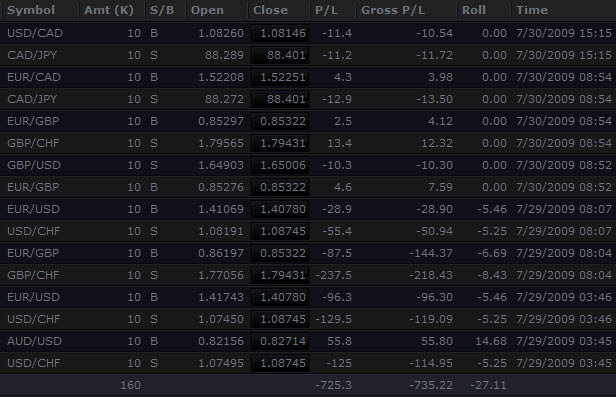

DislikedWell I'll answer. I'm up over 400 pips since Sunday on live trading. I've kept track of every trade this week and will post them at the end of the week.

P.S. It's a 787, not a 777.

Ignored

DislikedHi Jeffreytp

Lots of you are trading E/U vs G/U, but who tried backtest that big long on E/U from dec 08 ???? did you realize that G/U didnt make such long spike ?

do you realize that since 5th Dec 08 till that highs in next days euro went long 1900 pips !!!!!!!!! and G/U was choppy ?

so lets say you had seen "opportunity" make sell vs long on 5th Dec, on 18th dec your drawdown would be 1900 pips ... what next ? this thread would be dead,

Ignored

DislikedYep; took quite a hit on USDCHF/EURUSD yesterday. That's why I'm still demoing this.

Jeffery TP seems to have it figured out...Ignored

DislikedI opened a string of positions yesterday around 3:34am EST when the bear was hungry. Seems to be still hungry. Hasn't closed his mouth yet, but when he does, cha ching!

I entered a few today too.

Attachment

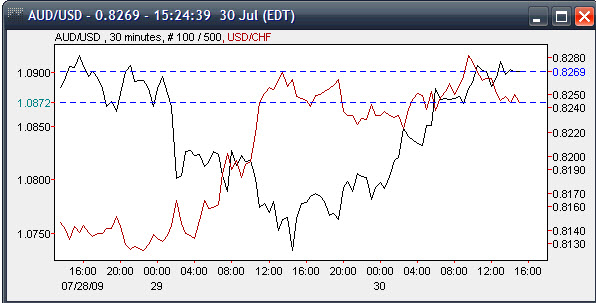

This is my problem child:

AttachmentIgnored