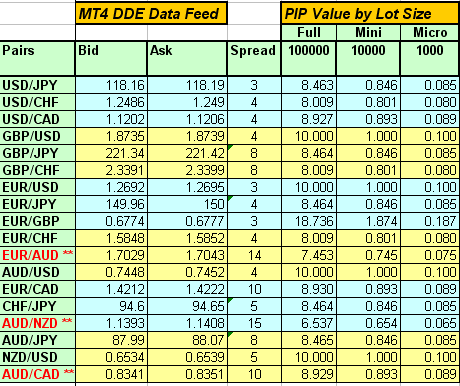

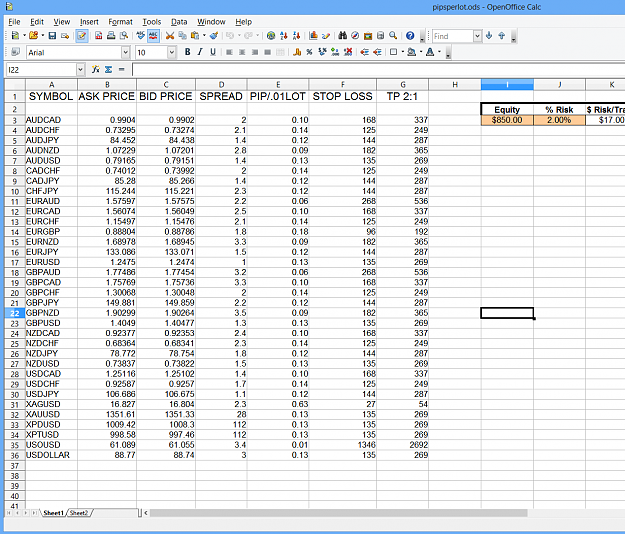

I did Read about calculating pip ,but the writer Only wrote about calculating pip with a 100,000$ Lot . This was how he Put it

Let say we are using eur/usd

0.0001 Divided by 1.2681 X 100000$ = 7.88$ per Pip (sounds fair enough)

But let say i am using a mini lot of 10000$

0.0001 divided by 1.2681 x 10000 = 0.788$ per pip? ( that would be about 70 Cents?)

And lets go Further by saying i am using a micro lot of 1000$

0.0001 Divided by 1.2681 x 1000 = 0.0788 cents per pip?? (That wouldnt even be a single cent ...Correct?)

Is this method of calculating correct ?

Let say we are using eur/usd

0.0001 Divided by 1.2681 X 100000$ = 7.88$ per Pip (sounds fair enough)

But let say i am using a mini lot of 10000$

0.0001 divided by 1.2681 x 10000 = 0.788$ per pip? ( that would be about 70 Cents?)

And lets go Further by saying i am using a micro lot of 1000$

0.0001 Divided by 1.2681 x 1000 = 0.0788 cents per pip?? (That wouldnt even be a single cent ...Correct?)

Is this method of calculating correct ?