Hello Everybody,

I just want to have a forum for discussing trading, methods, etc. I read the rules and wish to abide by them so any questions about where I trade, which software platform(s) I use, etc private message me so I can keep the forum 100% about trading concepts and strategies. I've tried this on other forums and it became unruly and thats why I choose Forex Factory. I like the ability I have to block negative people who only want to argue and slam people's ideas and have nothing positive to contribute.

Here's tomorrow's analysis.

I feel GBPCAD, NZDUSD, USDCAD, GBPUSD, EURCAD are most likely to go up. Buy on retracements and pullbacks if trend is up and stays above hourly 20 period simple MA.

Weakest pairs I feel will be EURJPY, EURGBP, AUDJPY and CADJPY weakest. USDCHF could be weakest but I'm not totally convinced but will be watching it in real time.

GBP/CAD Buy 1.7800 to 1.7750 and breakout of 1.8018

NZD/USD Buy .5450 to .5440 and .5400

USD/CAD Lightly buy 1.2330 and 1.2200 aggressively. Sell 1.2542-1.2550

GBP/USD Buy 1.4330 to 1.4300 and 1.4221 to 1.4200 aggressively!

EUR/CAD If CAD is weak and EUR/GBP going up buy this on dips.

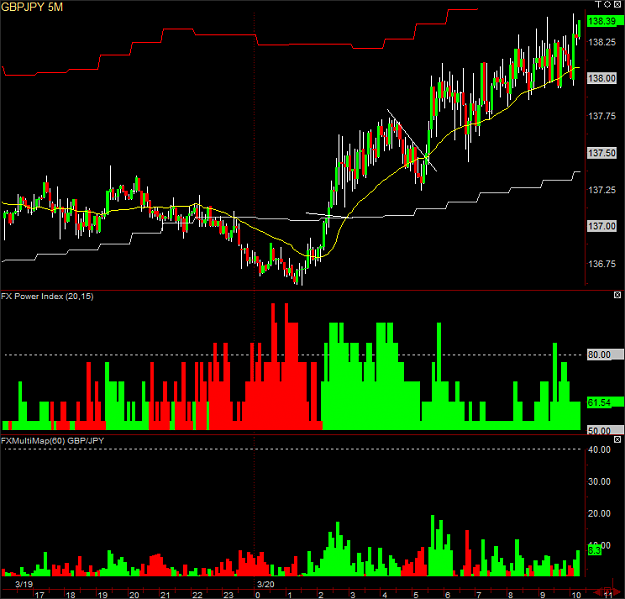

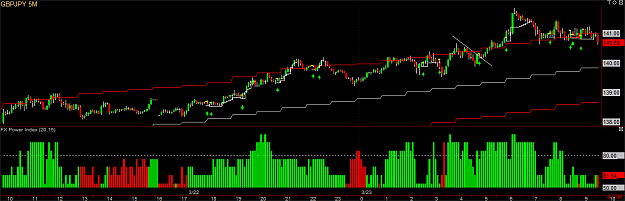

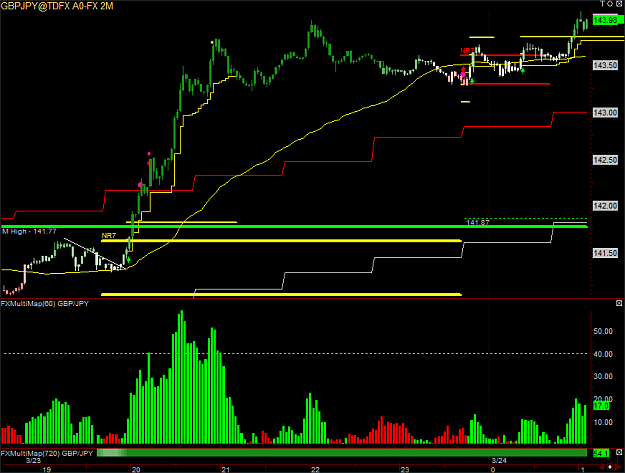

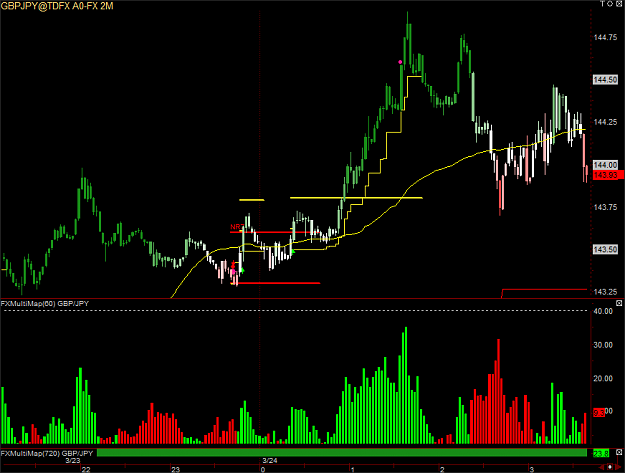

GBP/JPY Lightly sell 138.23 and aggressively 139.00

EUR/USD Sell 1.3850 to 1.3863 and aggressively 1.3940-1.3950!!

NZD/JPY Possible buy at 51.50 but if broken buy 51.00

AUD/USD If double top at today's high consider shorting .6950 and sell .7028 as this is extended and likely to reverse

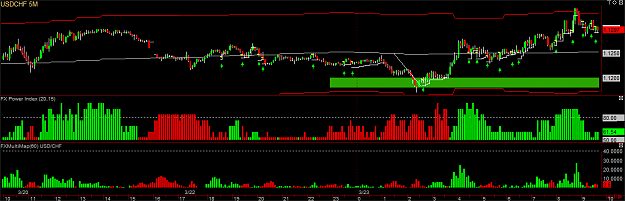

USD/CHF If it can't get over 1.1400 ie double top sell this area otherwise 1.1500 to 1.1568 should be high to sell

USD/JPY Lightly sell 95.50 to 95.67 and then sell 96.13, 96.50 and 96.77

EUR/JPY Should find resistance at 130.25 to 130.50 but if broken sell 131.00

EUR/GBP

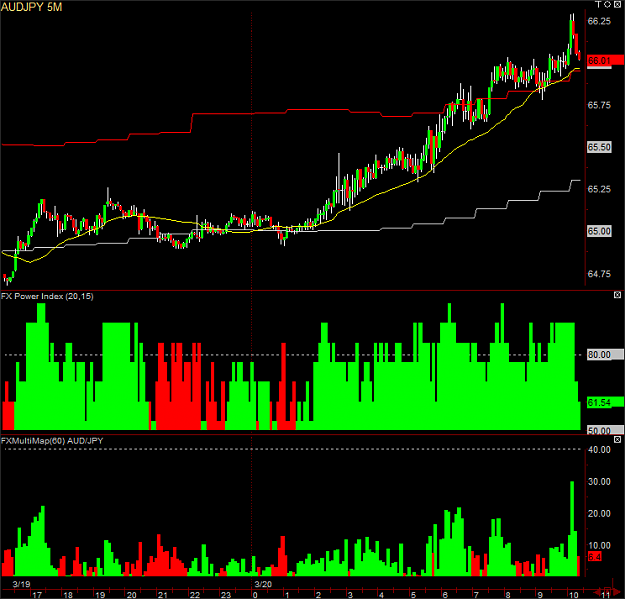

AUD/JPY Sell 65.81 to 66.00

CAD/JPY Sell 77.89 to 78.00

I just want to have a forum for discussing trading, methods, etc. I read the rules and wish to abide by them so any questions about where I trade, which software platform(s) I use, etc private message me so I can keep the forum 100% about trading concepts and strategies. I've tried this on other forums and it became unruly and thats why I choose Forex Factory. I like the ability I have to block negative people who only want to argue and slam people's ideas and have nothing positive to contribute.

Here's tomorrow's analysis.

I feel GBPCAD, NZDUSD, USDCAD, GBPUSD, EURCAD are most likely to go up. Buy on retracements and pullbacks if trend is up and stays above hourly 20 period simple MA.

Weakest pairs I feel will be EURJPY, EURGBP, AUDJPY and CADJPY weakest. USDCHF could be weakest but I'm not totally convinced but will be watching it in real time.

GBP/CAD Buy 1.7800 to 1.7750 and breakout of 1.8018

NZD/USD Buy .5450 to .5440 and .5400

USD/CAD Lightly buy 1.2330 and 1.2200 aggressively. Sell 1.2542-1.2550

GBP/USD Buy 1.4330 to 1.4300 and 1.4221 to 1.4200 aggressively!

EUR/CAD If CAD is weak and EUR/GBP going up buy this on dips.

GBP/JPY Lightly sell 138.23 and aggressively 139.00

EUR/USD Sell 1.3850 to 1.3863 and aggressively 1.3940-1.3950!!

NZD/JPY Possible buy at 51.50 but if broken buy 51.00

AUD/USD If double top at today's high consider shorting .6950 and sell .7028 as this is extended and likely to reverse

USD/CHF If it can't get over 1.1400 ie double top sell this area otherwise 1.1500 to 1.1568 should be high to sell

USD/JPY Lightly sell 95.50 to 95.67 and then sell 96.13, 96.50 and 96.77

EUR/JPY Should find resistance at 130.25 to 130.50 but if broken sell 131.00

EUR/GBP

AUD/JPY Sell 65.81 to 66.00

CAD/JPY Sell 77.89 to 78.00