Dislikedi don't think i've done a good job of explaining the idea

obviously this thread has nothing to do with how to obtain green pips... the focus is on maximizing those green pips when (or if) they come....

Understood

the first graph is profit/loss in terms of pips.

Yes, this is effectively fixed position size

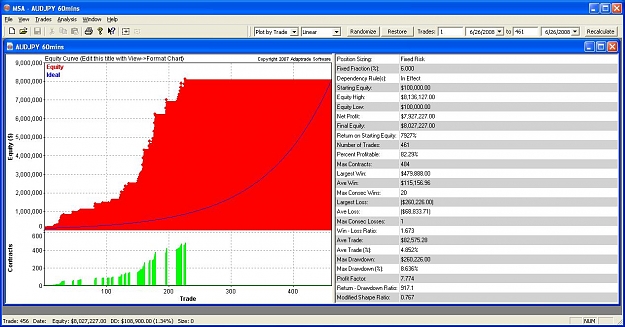

the second graph is elevating the risk once a certain percent has been achieved (the "house money" as i like to call it...)

This is a kind of anti-Martingale (although nowhere near as severe as doubling up following each win). After enough wins have occurred, causing equity to reach a certain value, the bet size increases, putting wins and losses on an equal weighting. But then when enough losses occur, at the larger bet size, the bet size is reduced, so the subsequent recovery rate is impeded. Look at the green histogram in relation to the wins and losses in the equity curve, and you will see this effect. Immediately the blue curve falls sufficiently, the green histogram falls also.

the third graph is a slow and steady increase in risk as the account grows

Yes, this will work fine as long as the account continues to grow. But the increased risk means bigger losses when if / when trading conditions no longer favor the system. In other words, the early trades (when position size is low), are recieving lower weighting. IMHO there needs to be a reason to justify this, i.e. why these trades are less likely to be profitable.

here's the point of the entire thread: trade 1/2 the account as demonstrated with the first MM and 1/2 the account as demonstrated w/ the second... the end result would have been +300% on the year (1/2 of 600%)....

I assume that by the first MM you're referring to post #3, and the second is post #4?

there are years when the 1st MM would have made several thousand percent for me.... so it is definitely worth considering trading that way, even with a small percentage of my account.... and supposing i did risk 1/2 my account, +300% would look very small compared to a few thousand %

The anti-Martingale will perform exceptionally during a winning streak, because you're effectively increasing your bet size as the winners roll out. (It's akin to pyramiding your trading positions during a prolonged trend). But then any losses are also subject to the increased bet size, so a sudden losing streak will just as quickly undo all of the good work. Then you have the problem of the slow recovery rate, which is where I assume that your MM in post #4 (on the separate account) is designed to compensate.

to do what i am saying, you'd need two different accounts, completely isolated from one anotherIgnored

Not quite sure what I'm missing........??

Also:

What is your profit factor?

How many trades in your sample size?

What is the win rate?

David