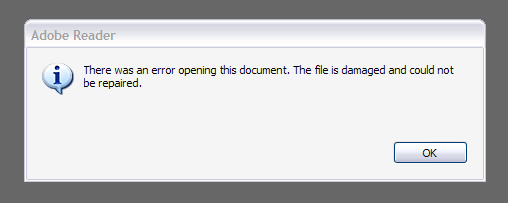

I'm having problems downloading the file. Any suggestions?

I upDated the program, but still this message poping up.

If someone sent this to me in oder format, like words, I will appreciate.

Thanks

I upDated the program, but still this message poping up.

If someone sent this to me in oder format, like words, I will appreciate.

Thanks

Attached Image