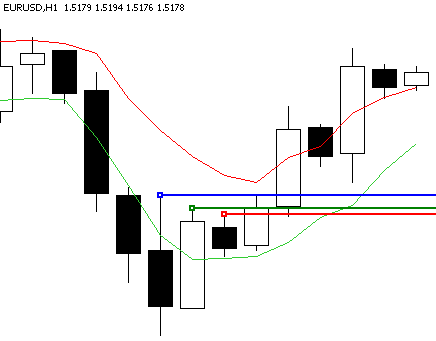

DislikedI took a cable long at great support (back side of channel upper line at pullback, and resistance now support) took 85 pips..

MattyIgnored

In your post 216, for tp of 85 pips, how did you determine the entry price. I sort of checked on my IBFX platform and the candles are different in 4 hours. I know it could be different somewhat, But regardless, Did you consider the enter price on this g/u trade DURING the 4 candle formation (not waiting for it to finish?). So as soon as it bypassed the black candle by 1 pip you enter the long trade.

Effi,

I am so happy to find this thread. You method and teaching is superb. It is very basics and easy to comprehend. I am very thankful for sharing your strategy. I love it.

I have re read the first post and other post for setup candle but not so sure that I know it correctly. Please let me know, this will help me immensely.

Since this is my first post to FF, I hope I am not including all of the screen shots along with it.

Thanks

Ak