I want to post a perfect set-up for the minute trading. To accomplish this you need to look at a longer time frame preferably 4x longer then the desired timeframe to enter. For added security you can look at one additional longer time frame. Example: Enter on a 5 minute. Look back at a 20 minute and possibly an 80 minute ot 1 hour.

Here are the keys to the kingdom to a good trade.

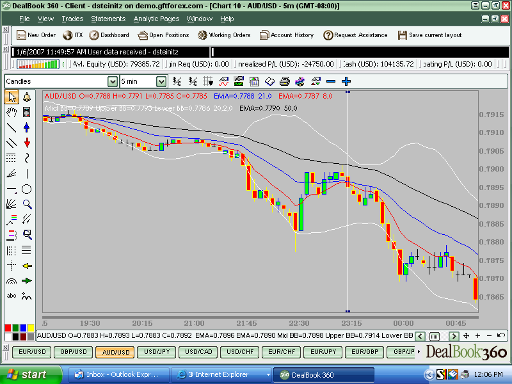

Short Trade 5 MIN

1. Enter on a 5 minute

2. 8 EMA less then 21 EMA

3. 8 & 21 EMA's are less then 50 EMA

4. 50 EMA is between the 20 period BB's

5. 8 EMA is starting to hinge down (bonus)

20 Min

1. Bar resting on 8 or 21 EMA (21 EMA would be a bonus)

2. Bar is a down close

3. 8 EMA less then 21 EMA

4. 8 & 21 EMA's are less then 50 EMA

5. 50 EMA is between the 20 period BB's

6. 8 EMA is starting to hinge down (bonus)

80 Min (or 1Hr)

1. Bar resting on 8 or 21 EMA (21 EMA would be a bonus)

2. Bar is a down close

3. 8 EMA less then 21 EMA

4. 8 & 21 EMA's are less then 50 EMA

5. 50 EMA is between the 20 period BB's

6. 8 EMA is starting to hinge down (bonus)

I have included three images for your inspection. Of course reverse the above for going long. I could very well post bad entries but there are numerous ones. If you ask me to do so I will when I have time.

You can exit the position when the 5 min violates the rules for a quick profit. If one is looking for a longer timeframe position with larger profit potential you can exit when 20 minute starts to violate the rules. If you do so you MUST have a solid looking 80 or 1 hour trend to do so. At this point you are depending on the 80 min or 1 hour to bring the 20 minute position into a profitable outcome by it's strong trend characteristics. If you are not a seasoned pro don't do this and be satisfied with your 5 Min strategy.

P.S. If anyone is interested. My last name is Steinitz. If you play chess seriously this name will ring a bell. My great great Grandfather Wilhelm Steinitz was the 1st World Chess champion which almost every book written today is based to some degree from his initial thoughts.

I don't wish anybody good luck, however I do wish you all "good standard deviations" !

"Steinitz" trader1

Here are the keys to the kingdom to a good trade.

Short Trade 5 MIN

1. Enter on a 5 minute

2. 8 EMA less then 21 EMA

3. 8 & 21 EMA's are less then 50 EMA

4. 50 EMA is between the 20 period BB's

5. 8 EMA is starting to hinge down (bonus)

20 Min

1. Bar resting on 8 or 21 EMA (21 EMA would be a bonus)

2. Bar is a down close

3. 8 EMA less then 21 EMA

4. 8 & 21 EMA's are less then 50 EMA

5. 50 EMA is between the 20 period BB's

6. 8 EMA is starting to hinge down (bonus)

80 Min (or 1Hr)

1. Bar resting on 8 or 21 EMA (21 EMA would be a bonus)

2. Bar is a down close

3. 8 EMA less then 21 EMA

4. 8 & 21 EMA's are less then 50 EMA

5. 50 EMA is between the 20 period BB's

6. 8 EMA is starting to hinge down (bonus)

I have included three images for your inspection. Of course reverse the above for going long. I could very well post bad entries but there are numerous ones. If you ask me to do so I will when I have time.

You can exit the position when the 5 min violates the rules for a quick profit. If one is looking for a longer timeframe position with larger profit potential you can exit when 20 minute starts to violate the rules. If you do so you MUST have a solid looking 80 or 1 hour trend to do so. At this point you are depending on the 80 min or 1 hour to bring the 20 minute position into a profitable outcome by it's strong trend characteristics. If you are not a seasoned pro don't do this and be satisfied with your 5 Min strategy.

P.S. If anyone is interested. My last name is Steinitz. If you play chess seriously this name will ring a bell. My great great Grandfather Wilhelm Steinitz was the 1st World Chess champion which almost every book written today is based to some degree from his initial thoughts.

I don't wish anybody good luck, however I do wish you all "good standard deviations" !

"Steinitz" trader1

Attached Images