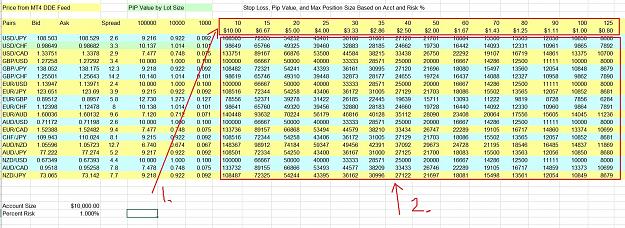

DislikedThis is a great calc as far as checking your math if you want to know how many units equal what risk % to your account. But you can't first set your risk % and have it calculate the units which is what I needed it to do. Guess I need to create my own Excel spreadsheet.Ignored

Que's keen to see this used and to get feedback

http://www.forexfactory.com/showthread.php?t=38909