This is VERY interesting...

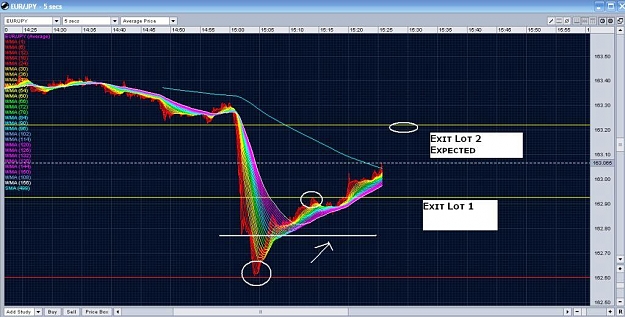

Here is another entry setup and exit setup from later on the same day as the previous post...

First thing to note is that after the big drop earlier in the day, price stayed above the Pivot... In this setup the Pivot breaks down...

The second thing to note is very subtle...

Compare the pattern of the entry setup on my previous post... To the pattern of the entry setup on this post... They are almost identical (which I never noticed until I was uploading)...

Now, this is either [a most impressive] coincidence.... Or...

There are common patterns occurring here... Not just flames and spines...

If I see this a third time... Hell, I'm going to name the bugger... Any ideas? :...

:...

Magnus

Here is another entry setup and exit setup from later on the same day as the previous post...

First thing to note is that after the big drop earlier in the day, price stayed above the Pivot... In this setup the Pivot breaks down...

The second thing to note is very subtle...

Compare the pattern of the entry setup on my previous post... To the pattern of the entry setup on this post... They are almost identical (which I never noticed until I was uploading)...

Now, this is either [a most impressive] coincidence.... Or...

There are common patterns occurring here... Not just flames and spines...

If I see this a third time... Hell, I'm going to name the bugger... Any ideas?

Magnus

Attached Image