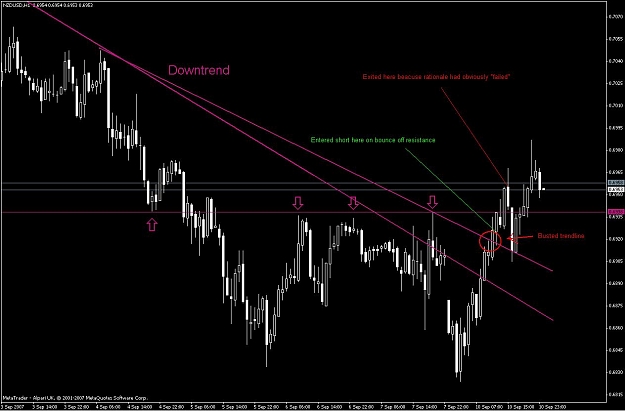

Please see the (NZDUSD,H1) chart below and tell me where I went wrong with the trade I made last night. I’m not being sarcastic (I promise!) but I’d especially like a response from those who believe that exit is more important than entry, or that profitable trading is all about MM or psychology.

My entry rationale was to trade with the downtrend. There was a decent S/R flipover forming strong resistance (see pink arrows). I waited for what I thought was a bounce off this resistance (see green annotation), and entered immediately, with what appeared to up to 5:1 R:R. Then I exited immediately it was apparent that the resistance had failed (red annotation). The end result was a loss that dented my account by 0.5% of its balance.

Did the fault lie with my entry (should have waited longer for the bounce to confirm itself)?

Or my exit (cut the loss too short)?

Or MM (risked only 0.5% of my account balance)?

Or psychology (made a disciplined entry, and a disciplined exit)?

Or did I ignore fundamentals at my peril? (Is it impossible to trade profitably using TA alone?)

Or was I just unlucky? (Until convinced otherwise, I believe that prices move randomly, and profitable trading is very much a matter of luck).

I have no problem accepting occasional losses, but I’m afraid that this kind of scenario is happening all too frequently. My account is down 11% since I started trading live back in June.

Again, I promise I’m not being sarcastic. I definitely admit some frustration though, especially when I start to take trading seriously.

Thanks in advance to anybody who can shed some light

David

My entry rationale was to trade with the downtrend. There was a decent S/R flipover forming strong resistance (see pink arrows). I waited for what I thought was a bounce off this resistance (see green annotation), and entered immediately, with what appeared to up to 5:1 R:R. Then I exited immediately it was apparent that the resistance had failed (red annotation). The end result was a loss that dented my account by 0.5% of its balance.

Did the fault lie with my entry (should have waited longer for the bounce to confirm itself)?

Or my exit (cut the loss too short)?

Or MM (risked only 0.5% of my account balance)?

Or psychology (made a disciplined entry, and a disciplined exit)?

Or did I ignore fundamentals at my peril? (Is it impossible to trade profitably using TA alone?)

Or was I just unlucky? (Until convinced otherwise, I believe that prices move randomly, and profitable trading is very much a matter of luck).

I have no problem accepting occasional losses, but I’m afraid that this kind of scenario is happening all too frequently. My account is down 11% since I started trading live back in June.

Again, I promise I’m not being sarcastic. I definitely admit some frustration though, especially when I start to take trading seriously.

Thanks in advance to anybody who can shed some light

David