The Nuts:

Any Timeframe;

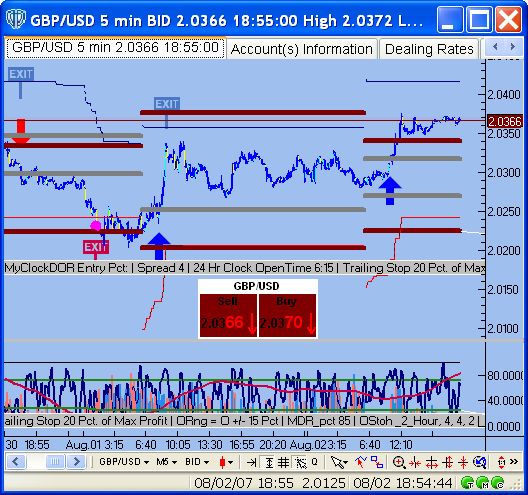

Calculate the Median Pip Movement/Bar in that Timeframe.

Get in when it moves 20% toward the Median.

Get Out when it reaches 80% of the Median.

The Bolts:

I haven't figured that out yet but I thought the Title would get me some help by way of 'Suggested Improvement.'

Actually I have figured it out but thought this might be a way to stop Juniors from chasing Rainbows.

:

:

Sorry if if I miss led you.

Any Timeframe;

Calculate the Median Pip Movement/Bar in that Timeframe.

Get in when it moves 20% toward the Median.

Get Out when it reaches 80% of the Median.

The Bolts:

I haven't figured that out yet but I thought the Title would get me some help by way of 'Suggested Improvement.'

Actually I have figured it out but thought this might be a way to stop Juniors from chasing Rainbows.

Sorry if if I miss led you.