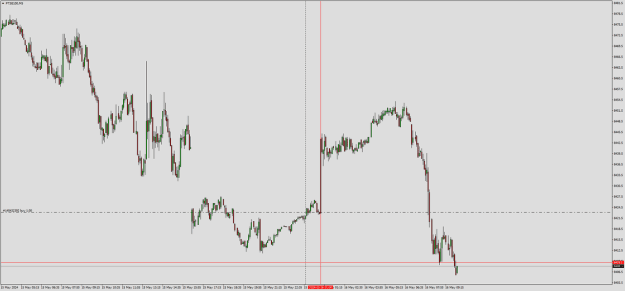

Gap closed but forgot to set TP on the second long position and it now moved back south. It's striking how this large candle filled the gap at exactly 01:00 GMT+1. Is there anything special about that time?

- Post #3,201

- Quote

- May 16, 2024 5:09am May 16, 2024 5:09am

- Joined May 2009 | Status: best wishes | 3,483 Posts

- Post #3,202

- Quote

- May 16, 2024 5:23am May 16, 2024 5:23am

- | Joined Mar 2007 | Status: One life - live it... | 606 Posts

Less is more...

- Post #3,203

- Quote

- May 16, 2024 5:29am May 16, 2024 5:29am

- Joined Oct 2020 | Status: Member | 6,000 Posts

B4 Elvis there was nothing

- Post #3,204

- Quote

- May 16, 2024 5:43am May 16, 2024 5:43am

- Joined May 2009 | Status: best wishes | 3,483 Posts

- Post #3,205

- Quote

- May 16, 2024 5:52am May 16, 2024 5:52am

- Joined May 2009 | Status: best wishes | 3,483 Posts

- Post #3,206

- Quote

- May 16, 2024 5:56am May 16, 2024 5:56am

- Joined Oct 2020 | Status: Member | 6,000 Posts

B4 Elvis there was nothing

- Post #3,207

- Quote

- May 16, 2024 5:57am May 16, 2024 5:57am

- Joined Oct 2020 | Status: Member | 6,000 Posts

B4 Elvis there was nothing

- Post #3,208

- Quote

- May 16, 2024 5:57am May 16, 2024 5:57am

- | Joined Mar 2007 | Status: One life - live it... | 606 Posts

Less is more...

- Post #3,209

- Quote

- May 16, 2024 5:59am May 16, 2024 5:59am

- Joined Oct 2020 | Status: Member | 6,000 Posts

B4 Elvis there was nothing

- Post #3,210

- Quote

- May 16, 2024 6:01am May 16, 2024 6:01am

- | Joined Mar 2007 | Status: One life - live it... | 606 Posts

Less is more...

- Post #3,212

- Quote

- May 16, 2024 6:20am May 16, 2024 6:20am

- Joined Oct 2020 | Status: Member | 6,000 Posts

B4 Elvis there was nothing

- Post #3,213

- Quote

- May 16, 2024 6:36am May 16, 2024 6:36am

- Joined May 2009 | Status: best wishes | 3,483 Posts

- Post #3,214

- Quote

- May 16, 2024 6:46am May 16, 2024 6:46am

- Joined May 2009 | Status: best wishes | 3,483 Posts

- Post #3,217

- Quote

- May 16, 2024 7:51am May 16, 2024 7:51am

- Joined May 2009 | Status: best wishes | 3,483 Posts

- Post #3,219

- Quote

- May 16, 2024 12:21pm May 16, 2024 12:21pm

- Joined Oct 2020 | Status: Member | 6,000 Posts

B4 Elvis there was nothing

- Post #3,220

- Quote

- May 16, 2024 12:40pm May 16, 2024 12:40pm

- Joined May 2009 | Status: best wishes | 3,483 Posts