BB Breakout Strategy

TimeFrame: M5

Indicators:

Bollinger Band: Period: 96, Deviations: 2.0, Apply to Close

RSI: Period 9, Apply to Close

Volumes

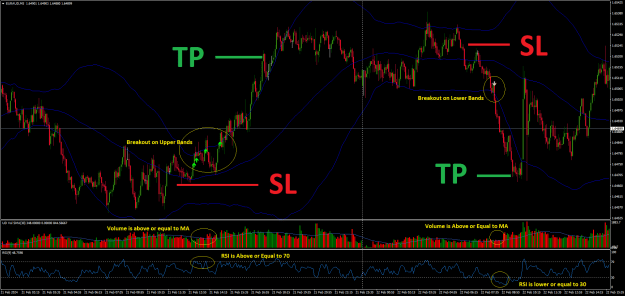

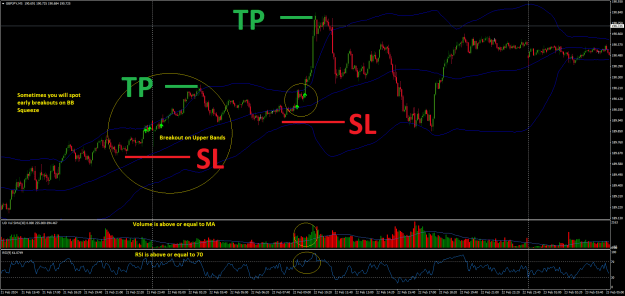

Buy Conditions:

First, we need to wait for the price to break the upper band, the price can be greater than or equal to the band.

Second, we need to check if there is a momentum by using RSI, the RSI should be greater than or equal to 70.

Third, we need to check if there is a volume on that breakout. Volume should be greater than average volume.

If these three conditions are present we go Long. R:R should be 1:3, and stoploss should be set below the latest swing low.

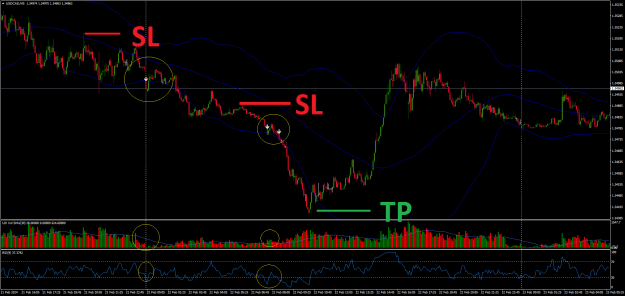

Sell Conditions

First, we need to wait for the price to break the lower band, the price can be lower than or equal to the band.

Second, we need to check if there is a momentum by using RSI, the RSI should be lower than or equal to 30.

Third, we need to check if there is a volume on that breakout. Volume should be greater than average volume.

If these three conditions are present we go Short. R:R should 1:3, and stoploss should be set above the latest swing high.

Side Notes: BicsOut indicator helps filter out most of the bad trades, and equip with alerts and notifications, if you are planning on using it on many pairs, kindly limit the Bars to minimum because the function inside the indicator is always looping and causing issues or slowing down your mt4, or use it only on your favorite pairs.

- You can find the latest version of the Expert Adviser here: *click me*

- The instructions for installation are here on this post: *click me*

Other resources used:

Sample Entries:

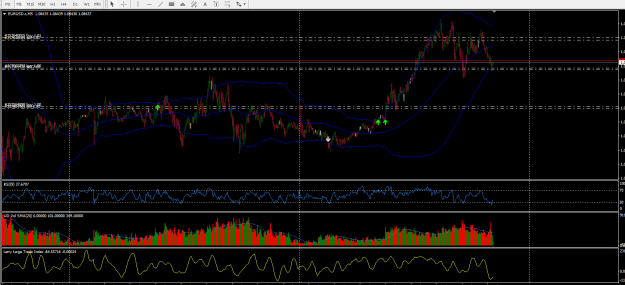

Restrictions during Consolidating Market

TimeFrame: M5

Indicators:

Bollinger Band: Period: 96, Deviations: 2.0, Apply to Close

RSI: Period 9, Apply to Close

Volumes

Buy Conditions:

First, we need to wait for the price to break the upper band, the price can be greater than or equal to the band.

Second, we need to check if there is a momentum by using RSI, the RSI should be greater than or equal to 70.

Third, we need to check if there is a volume on that breakout. Volume should be greater than average volume.

If these three conditions are present we go Long. R:R should be 1:3, and stoploss should be set below the latest swing low.

Sell Conditions

First, we need to wait for the price to break the lower band, the price can be lower than or equal to the band.

Second, we need to check if there is a momentum by using RSI, the RSI should be lower than or equal to 30.

Third, we need to check if there is a volume on that breakout. Volume should be greater than average volume.

If these three conditions are present we go Short. R:R should 1:3, and stoploss should be set above the latest swing high.

Side Notes: BicsOut indicator helps filter out most of the bad trades, and equip with alerts and notifications, if you are planning on using it on many pairs, kindly limit the Bars to minimum because the function inside the indicator is always looping and causing issues or slowing down your mt4, or use it only on your favorite pairs.

- You can find the latest version of the Expert Adviser here: *click me*

- The instructions for installation are here on this post: *click me*

Other resources used:

Attached File(s)

Attached File(s)

Attached File(s)

Attached File(s)

Sample Entries:

Restrictions during Consolidating Market

Attached File(s)

J.A.R.V.I.S. press the BUY button.