I believe that regardless of what setups you are using, you should always pair the weakest currency against the strongest currency. The first step is to determine your timeframes. I personally look at 2 time frames above the chart I make entries on.

In my case, entries come on the 15 Minute Chart. To determine strength, I do my analysis on the 1 Hour and 4 Hour charts. I like this combination because everything is divisible by the same number which is 4. This is a personal quirk of mine . In my opinion, it does not matter what you use as long as you are consistent.

. In my opinion, it does not matter what you use as long as you are consistent.

The obvious question becomes how do you determine strength, right?

There are many ways to do this and everyone will gravitate to what they like. Personally, these are the indicators I use on the 1 hour and 4 Hour charts to come up with a score.

In my case, entries come on the 15 Minute Chart. To determine strength, I do my analysis on the 1 Hour and 4 Hour charts. I like this combination because everything is divisible by the same number which is 4. This is a personal quirk of mine

The obvious question becomes how do you determine strength, right?

There are many ways to do this and everyone will gravitate to what they like. Personally, these are the indicators I use on the 1 hour and 4 Hour charts to come up with a score.

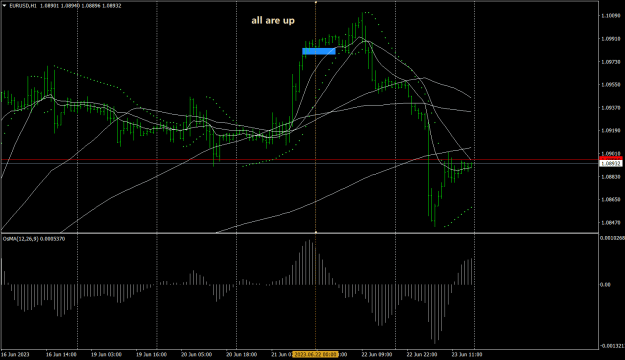

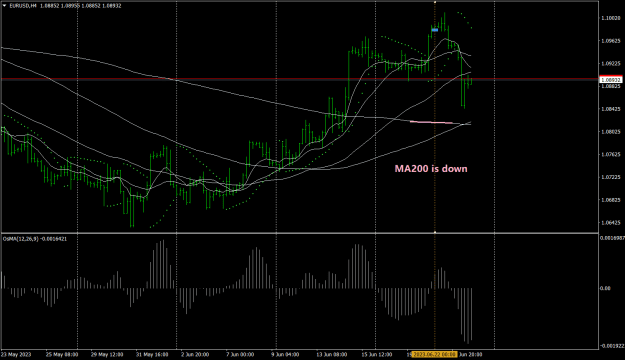

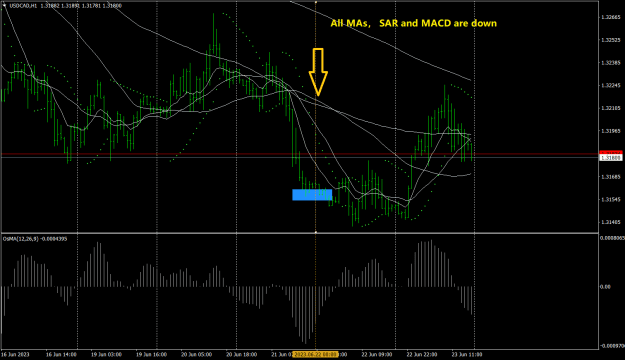

- SAR

- MACD Histogram

- 10 EMA

- 20 SMA

- 50 SMA

- 100 SMA

- 200 SMA

All of the Moving Averages are scored twice. The first is whether price is above or below and the second is the angle. The price could also be the same as the MA and the angle could be up, down or flat.

I hope this helps because in my experience, this has been the determining factor in becoming a successful trader.

Please Skip to Post #17