Hi there. I failed to see how the new breed of 'prop firm' is helpful to traders. If you are a good trader you would be much more profitable trading your own account.

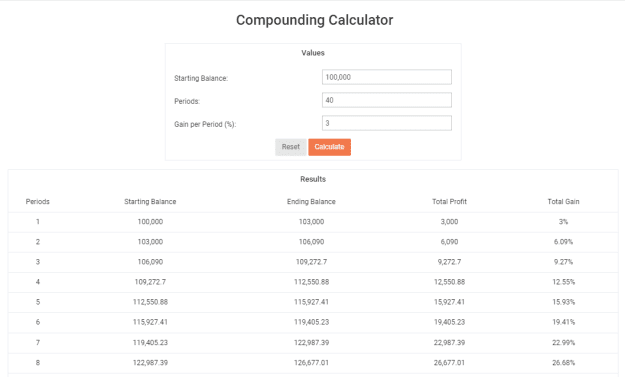

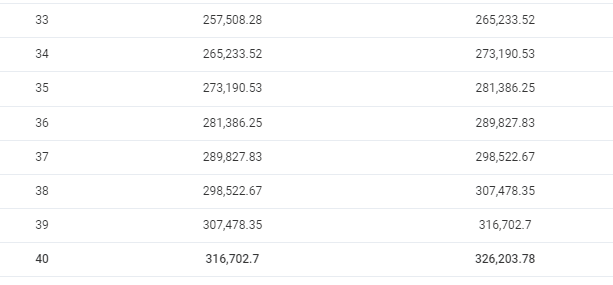

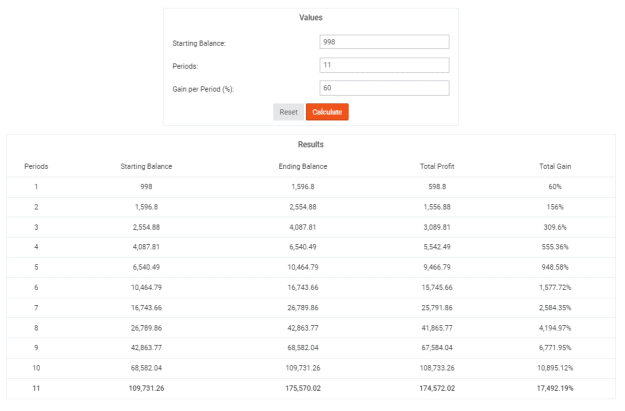

Below is a compounding calculator for a 100k account. The risk here is 0.5% per SL for a 1:2 RR trade(assuming 5% maximum drawdown, so we risk a tenth of that). So, 1% per TP. Say, per day you would win 3 trades. That is 3% per day. Calculator is here https://www.myfxbook.com/forex-calcu...ing-calculator

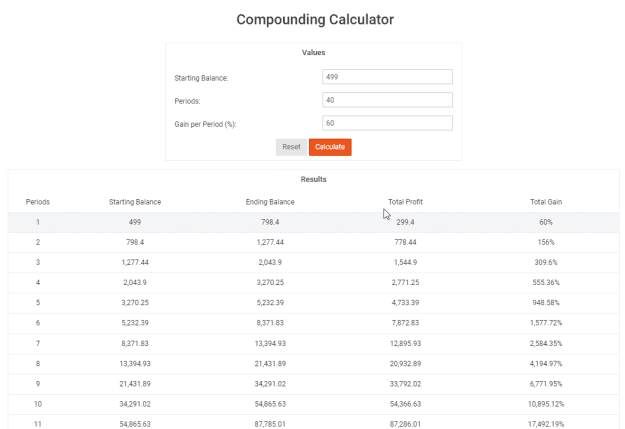

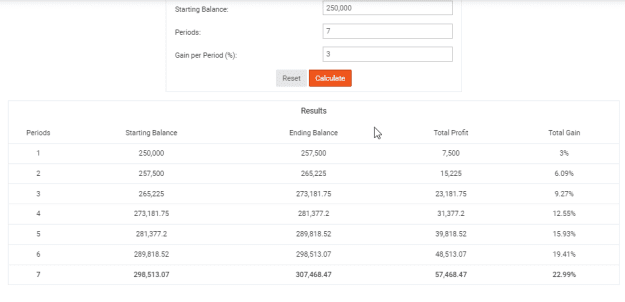

Below is a 499usd account(price of 100k challenge). Risk here is 10% per SL for a 1:2 RR trade(assuming 100% maximum drawdown, so we risk a tenth of that). So 20% per TP. Per day, you would win 3 trades. 60% per day.

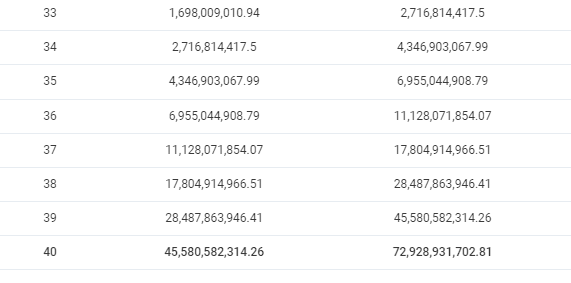

The amount you would gain with personal trading account is astronomically better than you would if you were to trade using a prop firm taking the same amount of risk. I compared 40 days to 40 days. In reality prop firms evaluation on average would set you back about 10 to 20 days which would reduce the Gain even further.

Can someone please enlighten me why prop firm is better and if my logic is wrong?

Below is a compounding calculator for a 100k account. The risk here is 0.5% per SL for a 1:2 RR trade(assuming 5% maximum drawdown, so we risk a tenth of that). So, 1% per TP. Say, per day you would win 3 trades. That is 3% per day. Calculator is here https://www.myfxbook.com/forex-calcu...ing-calculator

Below is a 499usd account(price of 100k challenge). Risk here is 10% per SL for a 1:2 RR trade(assuming 100% maximum drawdown, so we risk a tenth of that). So 20% per TP. Per day, you would win 3 trades. 60% per day.

The amount you would gain with personal trading account is astronomically better than you would if you were to trade using a prop firm taking the same amount of risk. I compared 40 days to 40 days. In reality prop firms evaluation on average would set you back about 10 to 20 days which would reduce the Gain even further.

Can someone please enlighten me why prop firm is better and if my logic is wrong?