i also thought the same when i came across this method, it looked to good to be true until i started doing it myself!

WARNING - it is EXTREMELY risky if you start to cost average - large drawdowns for sustained periods are inevitable

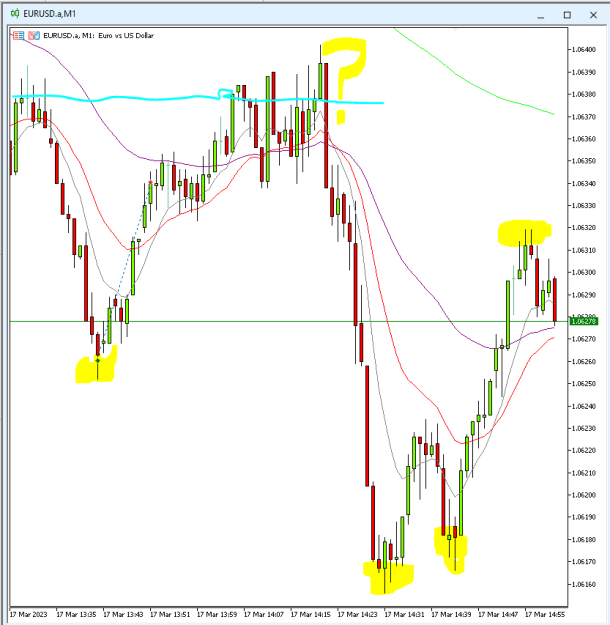

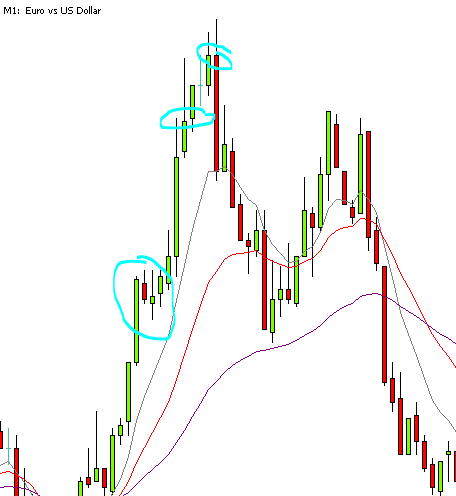

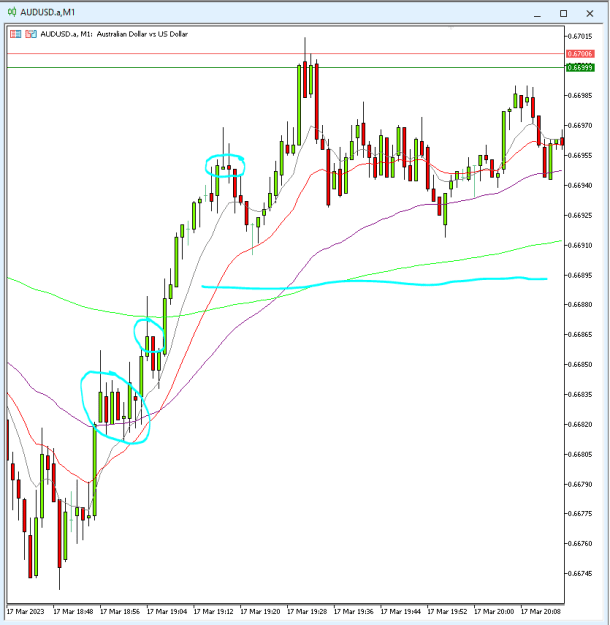

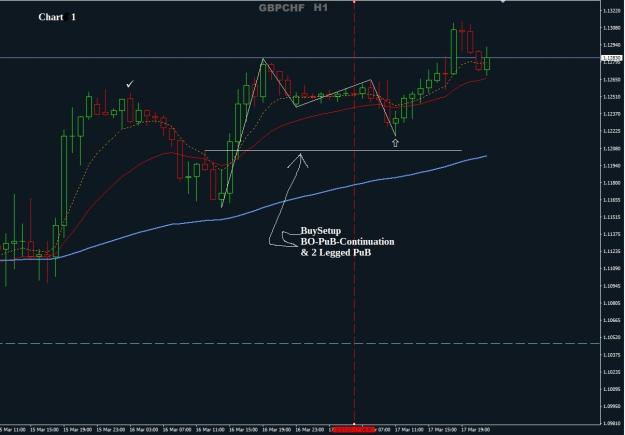

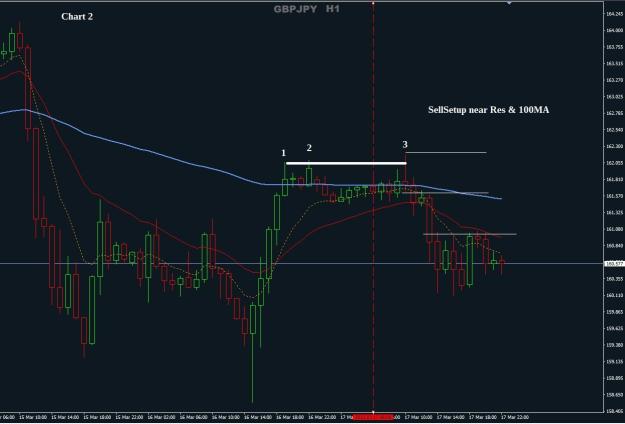

the entry is purely subjective simply based on an over extension from ema9, looking for some PA to enter countertrend, mainly wicks, then cost averaging until it reverses, using return to ema's and PA for targets

the bits in yellow are visually obvious entry points for countertrend - the question mark is not, it is still very close to the ema's, an entry here would be based on other factors like previous resistance

kc topics: https://www.forexfactory.com/thread/post/14648072#post14648072

FTMO Trial #3 All Time Return:

2.6%