DislikedI am here for learning and willing to open mind to listen other opinion and view. I am not looking for feed spoon. i rather listen and learn about trading basic and extra information, then hope someone give live trade and follow.Ignored

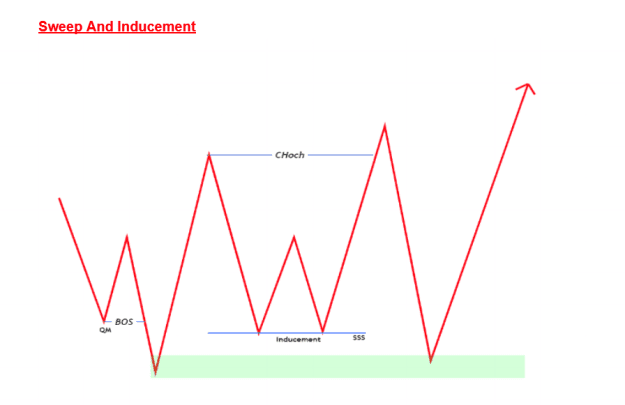

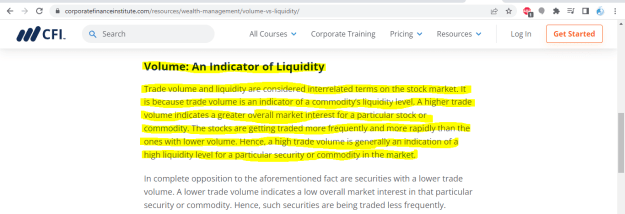

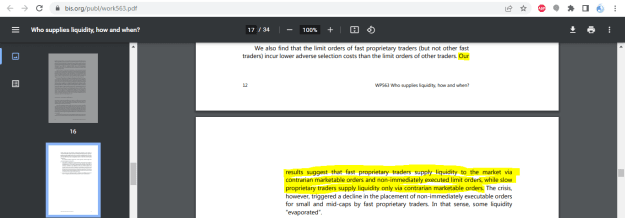

However volume data shows us what Liquidity mattered just recently - that's your liquidity areas I believe you are chasing.

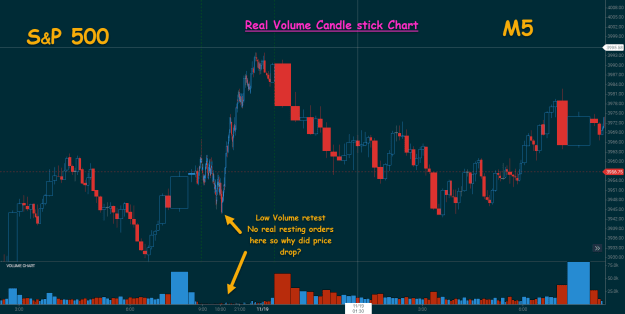

Here is a S&P M5 Chart from a couple days back that shows what volume actually executed. It therefore allows a trader to know later where the REAL liquidity actually was moments after execution.

You can see that large volume creates fat candles which are worthwhile trading setups by themselves (I trade them all night long on extremely short time frames).

I hope you notice these pullbacks to lows often occur for no real reason, as you can see there was no liquidity at the end of the move.

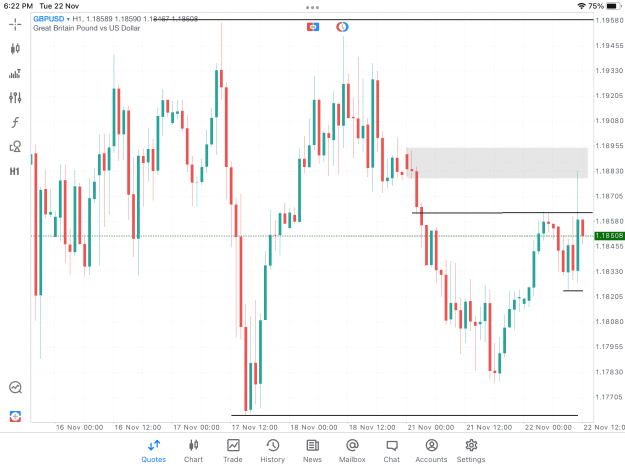

Trading thin liquidity at the boundary of the charts

5