Hey guys, I am welcome everyone trading using by structure and liquidity strategy to come here and sharing their view.

I personal really interest about how to spot liquidity and major and minor structure.

since I cant find one thread about this , so i create this one , hopefully here can gather more traders to share their view about liquidity.

I personal really interest about how to spot liquidity and major and minor structure.

since I cant find one thread about this , so i create this one , hopefully here can gather more traders to share their view about liquidity.

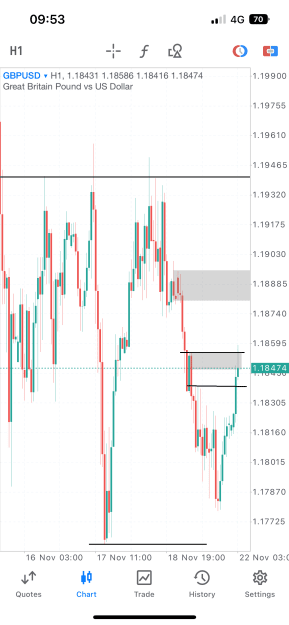

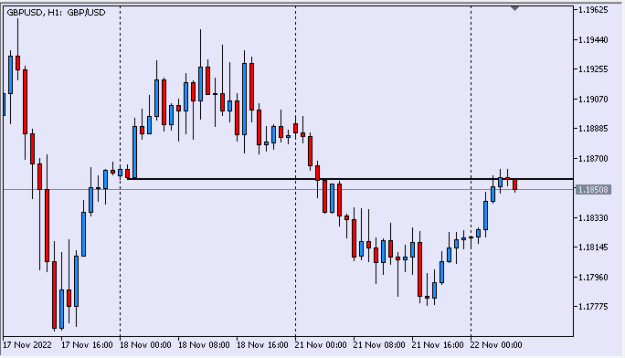

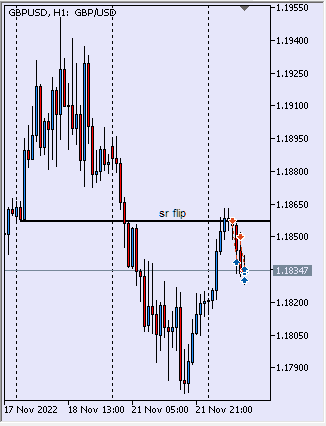

Training.