Disliked{quote} Thanks .....when and where is just when I feel, there is no % or certain amount of pips, that's something you need to figure out by yourself by practicing on demo, hence why the trades I post are random, open both directions, open one direction, sometimes pending, sometimes put hedge on straight away, sometime no tp, I've tried to mix it up a bit just to show different ways, it's just a tool maybe you can use parts to help with your own trading ....hope this helps...Ignored

This what Wave say here is just like i do it "slice from all", depend from my mood, weather outside, time how i have to play with fx...

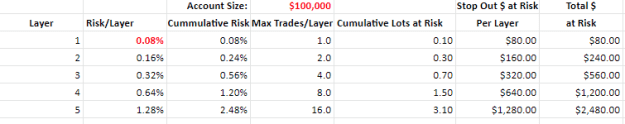

I dont use any indies, my only is MM.

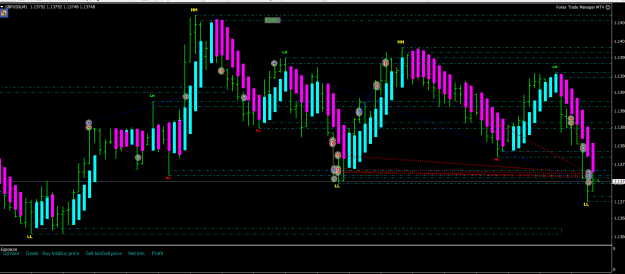

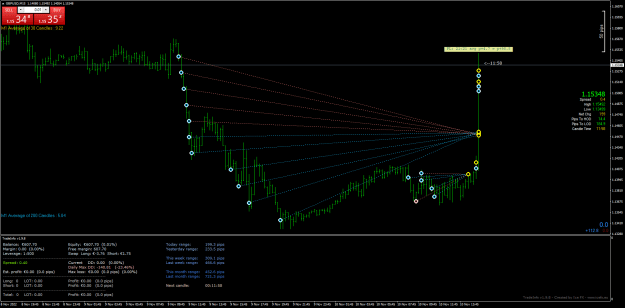

When dont have time to watch positions, placing pendings and TPs, hedging... On another way, when i have time for beer and chips, i put all my four up on armchair and watch how price dance on chart like football game and harvesting pips.

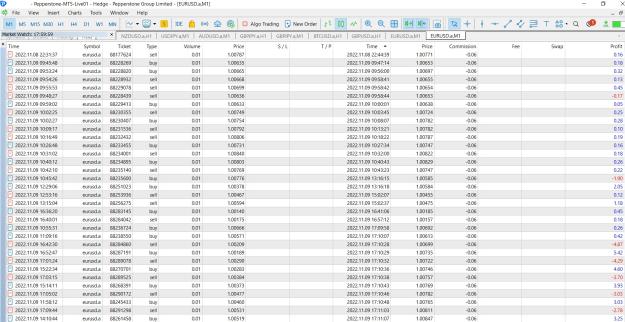

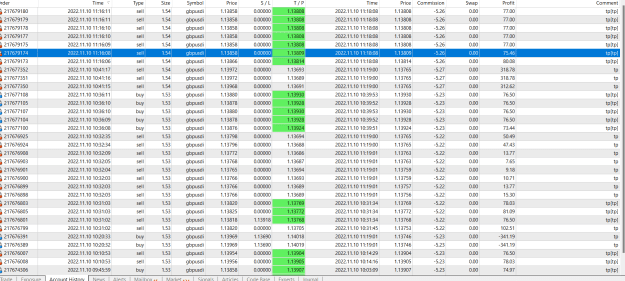

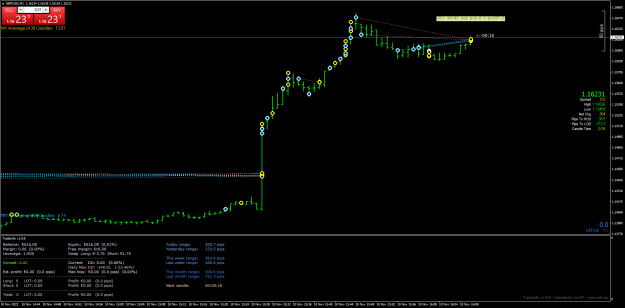

This from today sesion (for visual guys here, i seen here is enough ppls who dont understand Waves and Birds txt placements, so hope will be my 2cents).

I have today lot of free time to watch on graph while brewing beer at home, so no TPs and pendings... some hedging at end to dig out from hole.

Enjoy! Cheers!

3