Hello Folks,

Trend is your friend. Trade with the trend. Use 200 EMA for trend detection. Pretty common instructions...

I have been doing bit of research for trade bias filters as an algo/EA developer. I though I drop here one interesting finding of mine for discussion. Based on simple data collection test 200 EMA as trend filter seems to mostly be a trap !

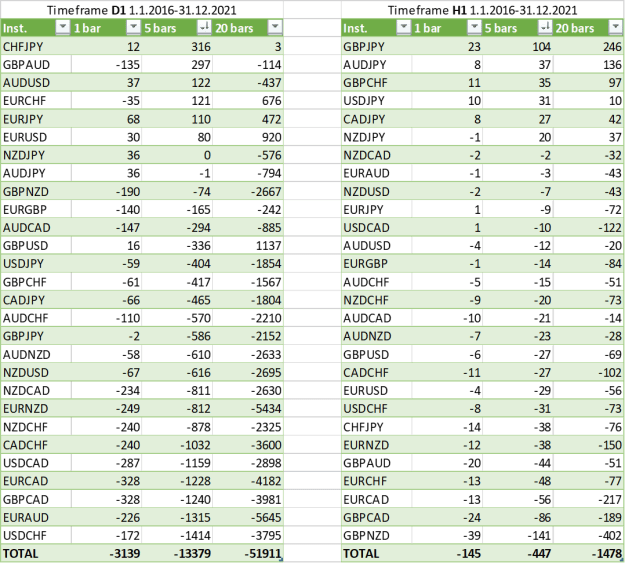

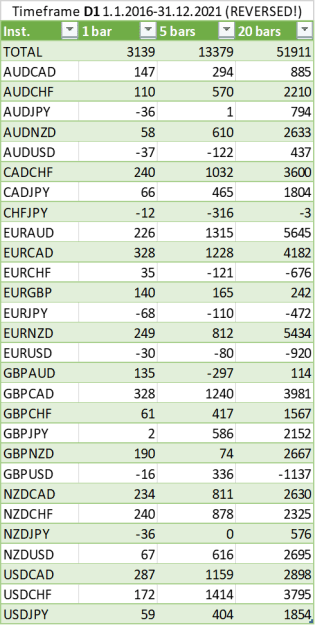

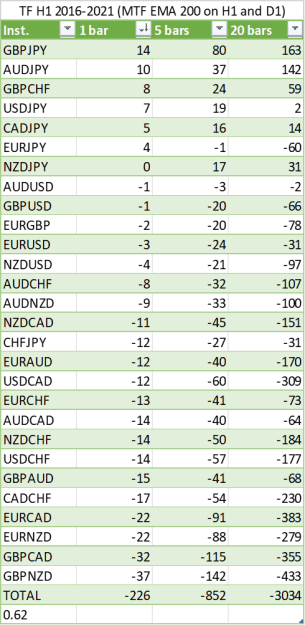

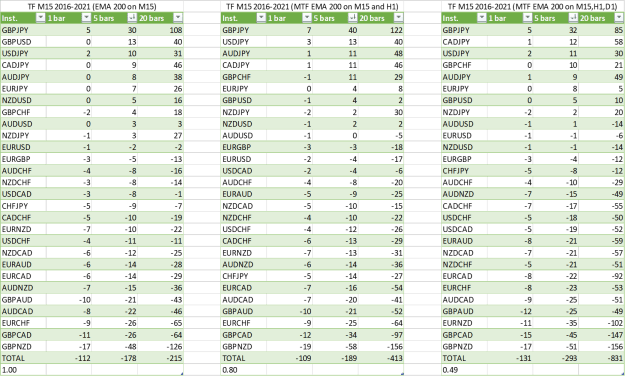

I made experiment where I simulate buy or sell on every bar (!) within time period of 1.1.2016-31.12.2021. Buy or sell decision is based on whether previous bar close was above or below 200 EMA. Then I simulated exit after 1, 5 and 20 bars and recorded profit or loss in points (without any spread). So basically random entry but with 200 EMA for bias and without trading costs.

Results were that 200 EMA on average makes performance quite a bit worse. There is couple of currency pairs where it is beneficial (e.g. JPY pairs on H1 timeframe) but on average it was hurting performance and in many pairs it would make much more sense to trade against it. Mean reverting nature of FX...

Attached is table with results for D1 and H1 bars and shows average amount of profit points for 1, 5 and 20 bars. Without bias filter assumed result would be 0. I have tested few other bias filters and durations etc and there clearly are better ones but I was sort of bit shocked how badly most common 200 EMA seems to work based on this kind of test.

Anyone with similar observations or some thoughts ? In case people are interested I might repeat same test but with some basic entry like MACD cross instead of every bar to see if 200 EMA looks bad also with such test.

Mika

{ email address deleted by staff }

Trend is your friend. Trade with the trend. Use 200 EMA for trend detection. Pretty common instructions...

I have been doing bit of research for trade bias filters as an algo/EA developer. I though I drop here one interesting finding of mine for discussion. Based on simple data collection test 200 EMA as trend filter seems to mostly be a trap !

I made experiment where I simulate buy or sell on every bar (!) within time period of 1.1.2016-31.12.2021. Buy or sell decision is based on whether previous bar close was above or below 200 EMA. Then I simulated exit after 1, 5 and 20 bars and recorded profit or loss in points (without any spread). So basically random entry but with 200 EMA for bias and without trading costs.

Results were that 200 EMA on average makes performance quite a bit worse. There is couple of currency pairs where it is beneficial (e.g. JPY pairs on H1 timeframe) but on average it was hurting performance and in many pairs it would make much more sense to trade against it. Mean reverting nature of FX...

Attached is table with results for D1 and H1 bars and shows average amount of profit points for 1, 5 and 20 bars. Without bias filter assumed result would be 0. I have tested few other bias filters and durations etc and there clearly are better ones but I was sort of bit shocked how badly most common 200 EMA seems to work based on this kind of test.

Anyone with similar observations or some thoughts ? In case people are interested I might repeat same test but with some basic entry like MACD cross instead of every bar to see if 200 EMA looks bad also with such test.

Mika

{ email address deleted by staff }