Supply Demand Trading with Trendline

Introduction to Supply Demand Trading with Trendline

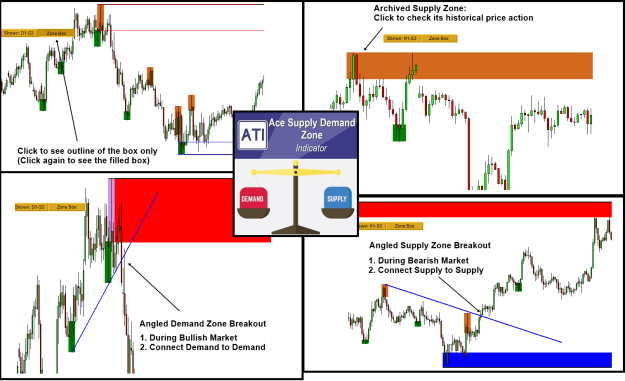

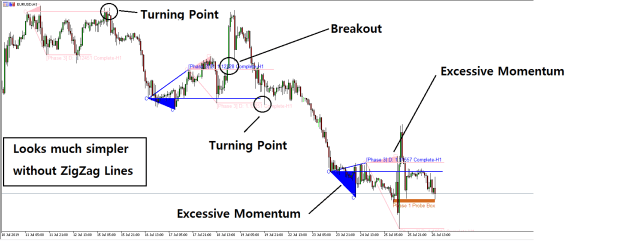

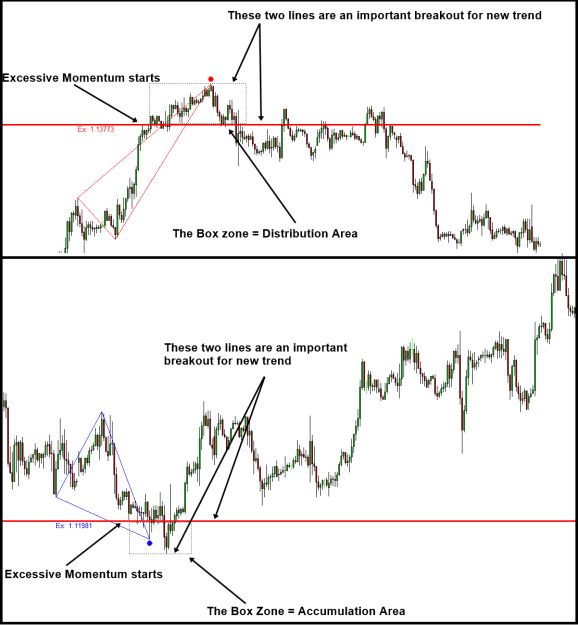

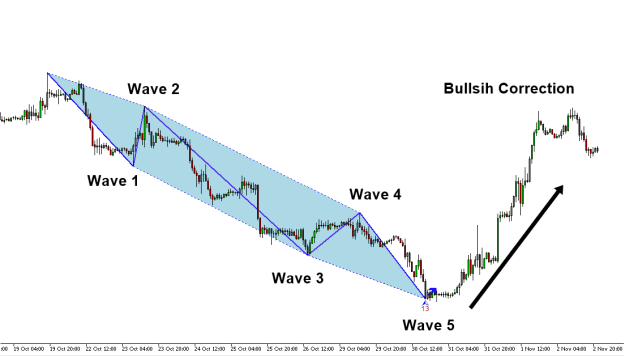

"Supply Demand Trading with Trendline" was formally known as the "Angled Supply Demand Zone Trading". Supply Demand Trading with Trendline is the advanced support and resistance trading in fact. The concept of "Supply Demand Trading with Trendline" was first developed by Young Ho Seo in 2019. In 2019, this technique was called "Angled Supply Demand Zone Trading". Hence, you can consider the supply demand trading with trendline and angled supply demand trading are identical. The essence of "Supply Demand Trading with Trendline" or "Angled Supply Demand Zone Trading" is to reuse the historical supply demand zones for some ingenious purpose. Please read this free article until to the end to master this trading strategy so that you can bring your trading skills to another level. As we have mentioned often, this trading strategy could be extra skills on top of the classic Supply Demand Trading.

If you are relying on trading income, good trading strategy is your workhorse for every day. Supply and demand zone concept is widely used among traders for several reasons. It is relatively simple to start with. In addition, it is effective in picking up the profitable moment. In fact, Supply and Demand zone is the extended concept from support and resistance at some points. The trading zone concept adds different values to our trading. For example, with zone, it is much easier to define our trading scenario and risk management than just simple price level from support and resistance. However, there is no perfect trading system in the world (i.e. being profitable and perfect is two different things). Of course, supply and demand zone concept has its own weakness too. For example, many traders still find it difficult to find good supply and demand zone to trade. Hence, some trader relies on the supply and demand indicator rather than the manual detection of the zone. Another difficulty is to find some good guide on how to trade with profits. It is difficult to find which online article is the genuine and profitable one.

You can continue to read full article here from the link below. This article will explains everything about "Supply Demand Trading with Trendline". It is free but informative article.

https://algotrading-investment.com/2...ng-tutorial-1/

Note about Supply Demand Trading with Trendline

The good news about supply demand trading with trendline is that it does not alter the original concept of supply demand trading. However, it helps you to find more accurate supply and demand zone to trade. You can take the breakout through the angled line as the double confirmation of the direction of your supply and demand trading. Therefore, any supply and demand zone trader can use Angled supply demand trading on top of their typical trading setup. When you draw the angled line or trendline, you might take some guide from GANN’s FAN or GANN’s angle, but this is not compulsory. There are many ways you can draw the trendline using historical supply and demand zone. Please practice as it was shown in this article and then build up the logic and skill gradually.

Supply and Demand Indicator

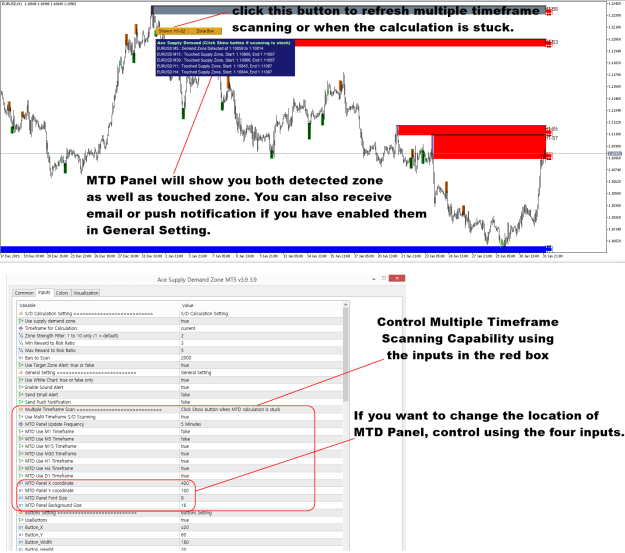

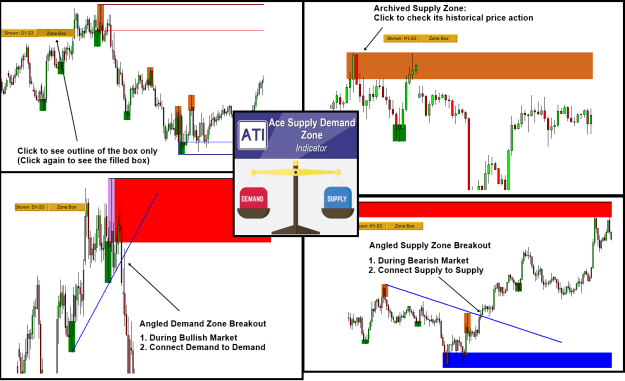

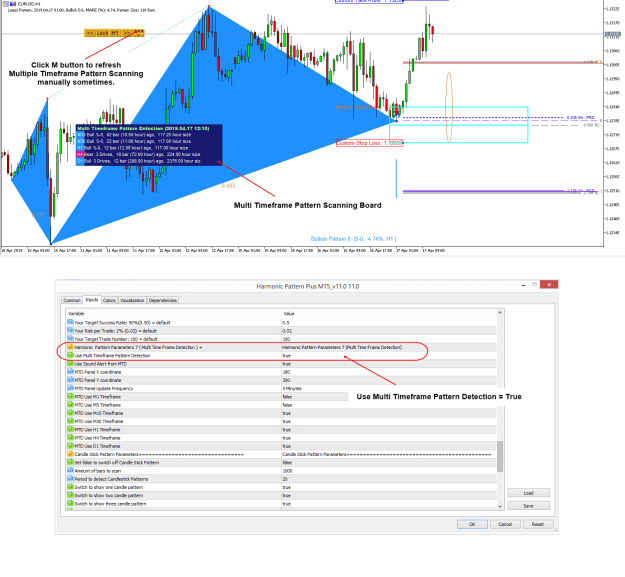

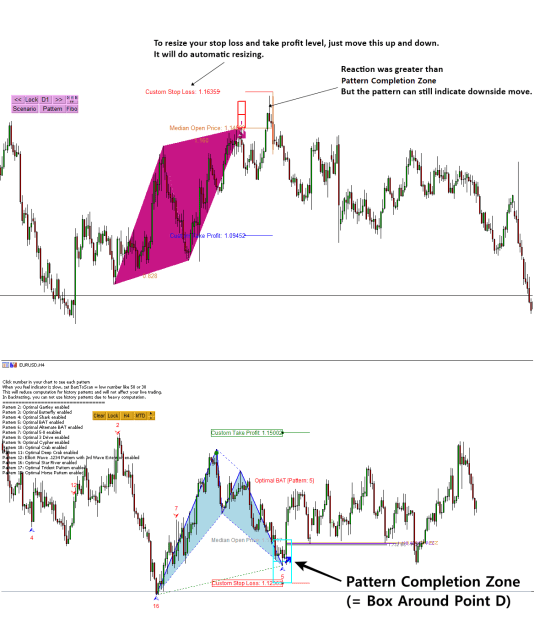

Ace Supply Demand Zone indicator was built upon non-repainting and non-lagging principle. It is multi-purpose Supply Demand Zone indicator for any level of trader. We especially built this Ace Supply Demand Zone indicator to improve the accuracy of supply and demand trading. This supply and deamnd indicator is available through several channels from below links.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/p...y-demand-zone/

Introduction to Supply Demand Trading with Trendline

"Supply Demand Trading with Trendline" was formally known as the "Angled Supply Demand Zone Trading". Supply Demand Trading with Trendline is the advanced support and resistance trading in fact. The concept of "Supply Demand Trading with Trendline" was first developed by Young Ho Seo in 2019. In 2019, this technique was called "Angled Supply Demand Zone Trading". Hence, you can consider the supply demand trading with trendline and angled supply demand trading are identical. The essence of "Supply Demand Trading with Trendline" or "Angled Supply Demand Zone Trading" is to reuse the historical supply demand zones for some ingenious purpose. Please read this free article until to the end to master this trading strategy so that you can bring your trading skills to another level. As we have mentioned often, this trading strategy could be extra skills on top of the classic Supply Demand Trading.

If you are relying on trading income, good trading strategy is your workhorse for every day. Supply and demand zone concept is widely used among traders for several reasons. It is relatively simple to start with. In addition, it is effective in picking up the profitable moment. In fact, Supply and Demand zone is the extended concept from support and resistance at some points. The trading zone concept adds different values to our trading. For example, with zone, it is much easier to define our trading scenario and risk management than just simple price level from support and resistance. However, there is no perfect trading system in the world (i.e. being profitable and perfect is two different things). Of course, supply and demand zone concept has its own weakness too. For example, many traders still find it difficult to find good supply and demand zone to trade. Hence, some trader relies on the supply and demand indicator rather than the manual detection of the zone. Another difficulty is to find some good guide on how to trade with profits. It is difficult to find which online article is the genuine and profitable one.

You can continue to read full article here from the link below. This article will explains everything about "Supply Demand Trading with Trendline". It is free but informative article.

https://algotrading-investment.com/2...ng-tutorial-1/

Note about Supply Demand Trading with Trendline

The good news about supply demand trading with trendline is that it does not alter the original concept of supply demand trading. However, it helps you to find more accurate supply and demand zone to trade. You can take the breakout through the angled line as the double confirmation of the direction of your supply and demand trading. Therefore, any supply and demand zone trader can use Angled supply demand trading on top of their typical trading setup. When you draw the angled line or trendline, you might take some guide from GANN’s FAN or GANN’s angle, but this is not compulsory. There are many ways you can draw the trendline using historical supply and demand zone. Please practice as it was shown in this article and then build up the logic and skill gradually.

Supply and Demand Indicator

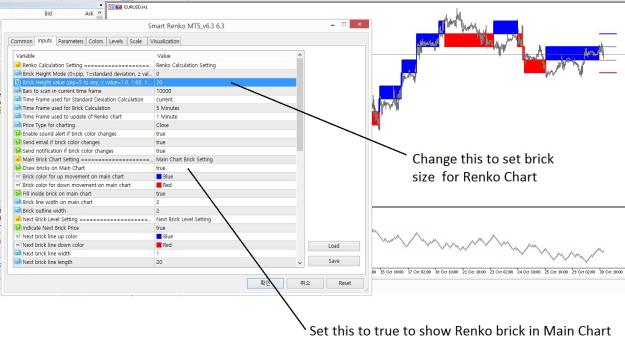

Ace Supply Demand Zone indicator was built upon non-repainting and non-lagging principle. It is multi-purpose Supply Demand Zone indicator for any level of trader. We especially built this Ace Supply Demand Zone indicator to improve the accuracy of supply and demand trading. This supply and deamnd indicator is available through several channels from below links.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/p...y-demand-zone/