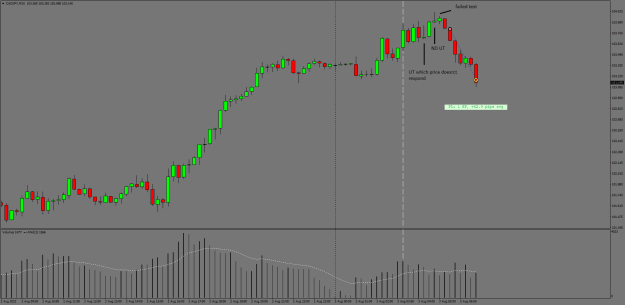

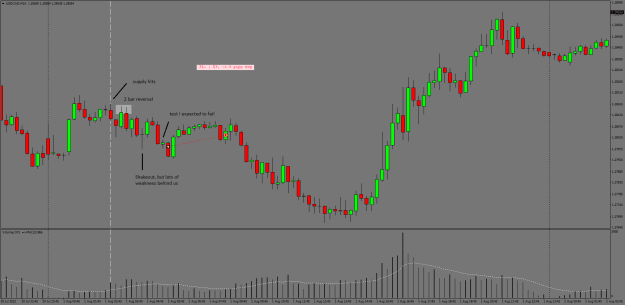

Appreciate you sharing the trade. Can you elaborate on your entry? I see it's a successful trade but I don't quite understand the rationale behind the entry unless the chart you shared is not the chart you used for your entry? I see some absorption in the bar prior to your entry but I don't see any low volume/testing (which AFAIK is the typical/ideal VSA pre-entry price action)

- Post #35,742

- Quote

- Jul 25, 2022 9:05am Jul 25, 2022 9:05am

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #35,743

- Quote

- Jul 25, 2022 8:30pm Jul 25, 2022 8:30pm

- Joined May 2020 | Status: Member | 300 Posts

- Post #35,744

- Quote

- Jul 25, 2022 11:57pm Jul 25, 2022 11:57pm

- Joined Jan 2015 | Status: Member | 1,288 Posts | Online Now

- Post #35,745

- Quote

- Jul 26, 2022 7:53am Jul 26, 2022 7:53am

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #35,746

- Quote

- Jul 26, 2022 2:54pm Jul 26, 2022 2:54pm

- Joined Feb 2021 | Status: Member | 716 Posts

- Post #35,748

- Quote

- Jul 26, 2022 8:52pm Jul 26, 2022 8:52pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #35,749

- Quote

- Edited Jul 27, 2022 12:15am Jul 26, 2022 11:18pm | Edited Jul 27, 2022 12:15am

- Joined Jan 2015 | Status: Member | 1,288 Posts | Online Now

- Post #35,753

- Quote

- Aug 2, 2022 9:54pm Aug 2, 2022 9:54pm

- Joined Sep 2015 | Status: Member | 2,219 Posts

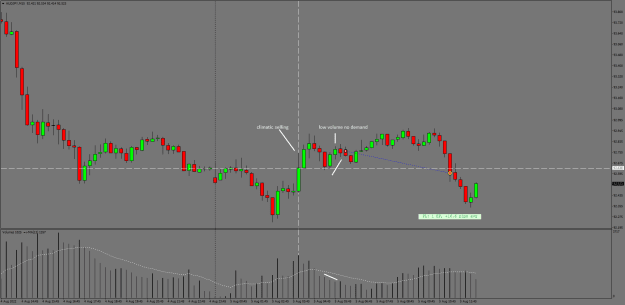

Trading thin liquidity at the boundary of the charts

- Post #35,754

- Quote

- Aug 3, 2022 12:21am Aug 3, 2022 12:21am

- Joined Jan 2015 | Status: Member | 1,288 Posts | Online Now

- Post #35,755

- Quote

- Aug 4, 2022 6:01pm Aug 4, 2022 6:01pm

- | Joined May 2022 | Status: Member | 34 Posts

- Post #35,757

- Quote

- Aug 5, 2022 5:54am Aug 5, 2022 5:54am

- Joined Jan 2015 | Status: Member | 1,288 Posts | Online Now

- Post #35,758

- Quote

- Aug 7, 2022 10:10pm Aug 7, 2022 10:10pm

- | Joined Aug 2022 | Status: Member | 11 Posts

- Post #35,759

- Quote

- Aug 8, 2022 3:06am Aug 8, 2022 3:06am

- | Joined Aug 2022 | Status: Member | 11 Posts

- Post #35,760

- Quote

- Aug 9, 2022 5:00am Aug 9, 2022 5:00am

- Joined May 2020 | Status: Member | 300 Posts