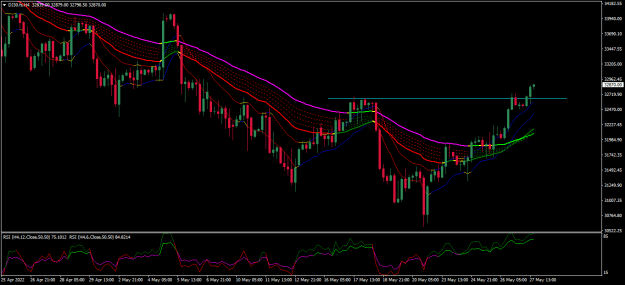

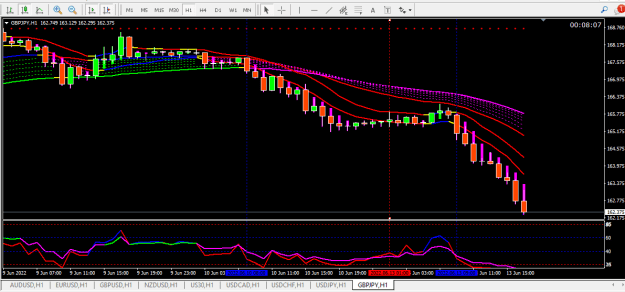

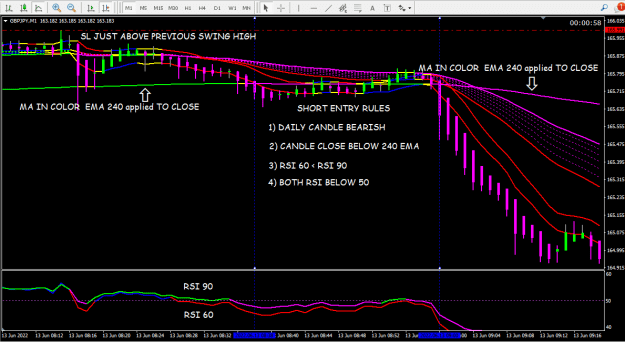

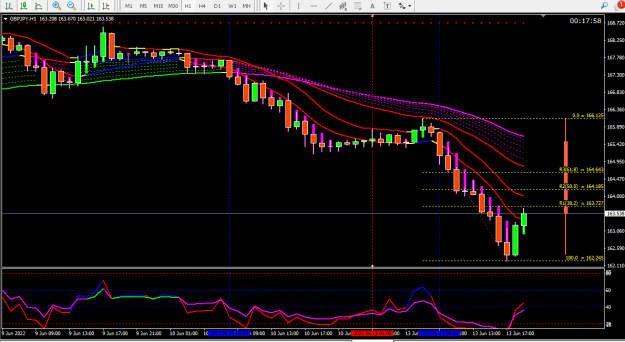

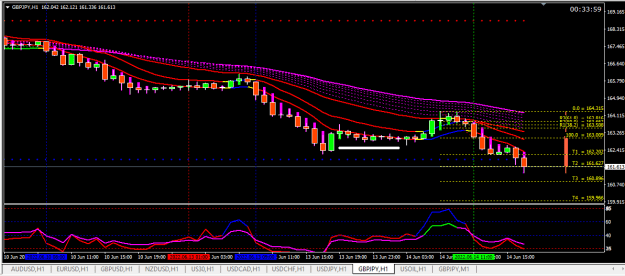

Dislikedany one watching DOW chart. this is situation on H4 now {image} look at perfect retracement on fib. almost to the pip. if the current candle or next candle closes below 10 ema channel and both rsi below 50, it will be a good opportunity to go short.Ignored

- Joined Jan 2013 | Status: Member | 4,173 Posts

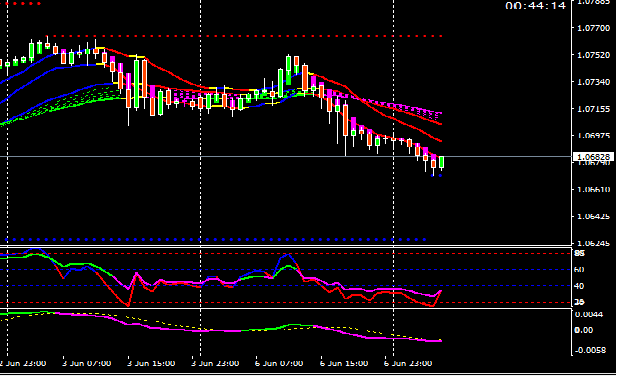

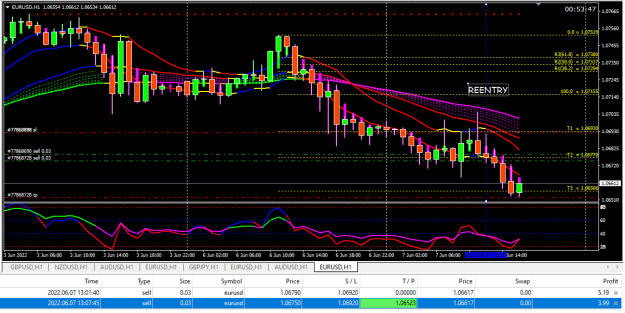

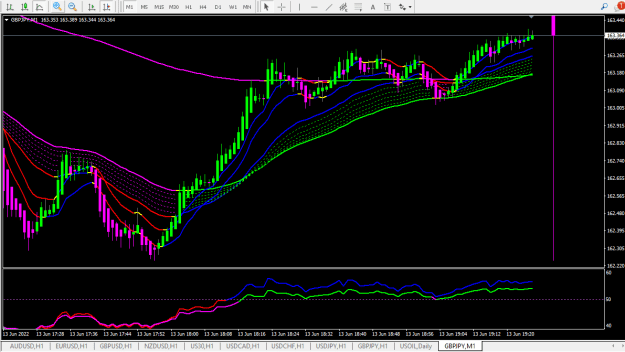

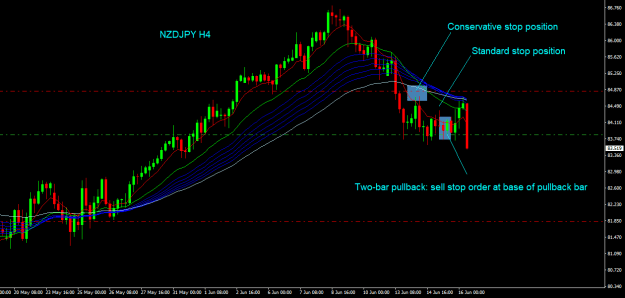

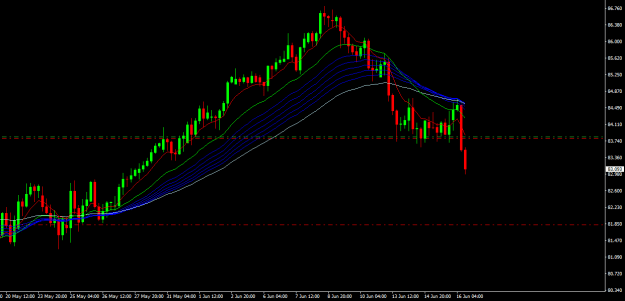

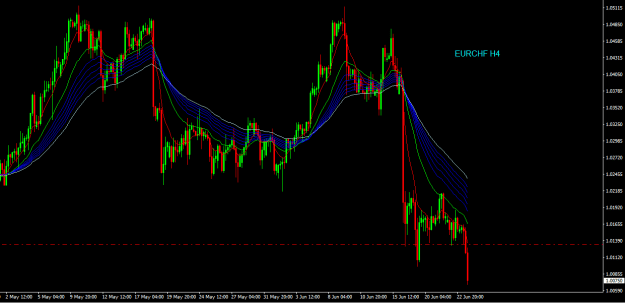

MA provides the market's current direction and strength.