I call upon my father's spirit , watching over me

- Post #3,081

- Quote

- Jun 8, 2022 4:35am Jun 8, 2022 4:35am

- Joined Aug 2014 | Status: Member | 75,989 Posts

- Post #3,082

- Quote

- Jun 8, 2022 4:39am Jun 8, 2022 4:39am

- Joined Aug 2014 | Status: Member | 75,989 Posts

I call upon my father's spirit , watching over me

- Post #3,083

- Quote

- Jun 8, 2022 4:55am Jun 8, 2022 4:55am

- Joined Aug 2014 | Status: Member | 75,989 Posts

I call upon my father's spirit , watching over me

- Post #3,085

- Quote

- Jun 8, 2022 5:03am Jun 8, 2022 5:03am

- Joined Aug 2014 | Status: Member | 75,989 Posts

I call upon my father's spirit , watching over me

- Post #3,086

- Quote

- Jun 8, 2022 5:07am Jun 8, 2022 5:07am

- Joined Aug 2014 | Status: Member | 75,989 Posts

I call upon my father's spirit , watching over me

- Post #3,088

- Quote

- Jun 8, 2022 6:00am Jun 8, 2022 6:00am

- Joined Jan 2007 | Status: Member | 11,829 Posts

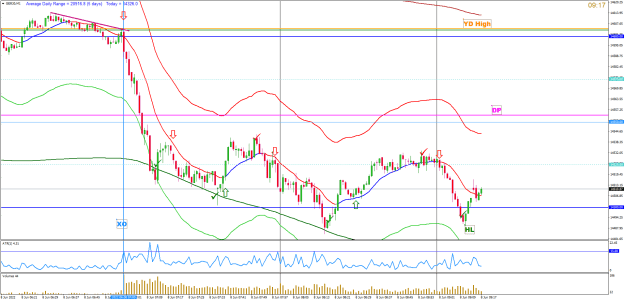

Trading Levels with WRBs

- Post #3,090

- Quote

- Jun 8, 2022 6:59am Jun 8, 2022 6:59am

- Joined Jan 2007 | Status: Member | 11,829 Posts

Trading Levels with WRBs

- Post #3,092

- Quote

- Jun 8, 2022 7:42am Jun 8, 2022 7:42am

- Joined Jan 2007 | Status: Member | 11,829 Posts

Trading Levels with WRBs

- Post #3,095

- Quote

- Jun 8, 2022 8:33am Jun 8, 2022 8:33am

- Joined Nov 2008 | Status: Member | 3,041 Posts

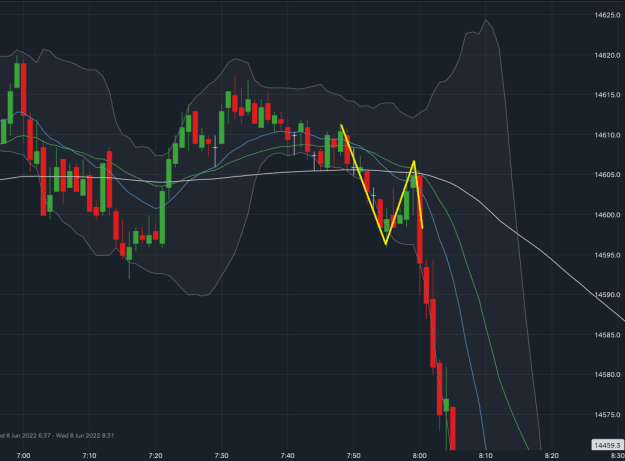

- Post #3,097

- Quote

- Jun 8, 2022 9:06am Jun 8, 2022 9:06am

- Joined Nov 2008 | Status: Member | 3,041 Posts

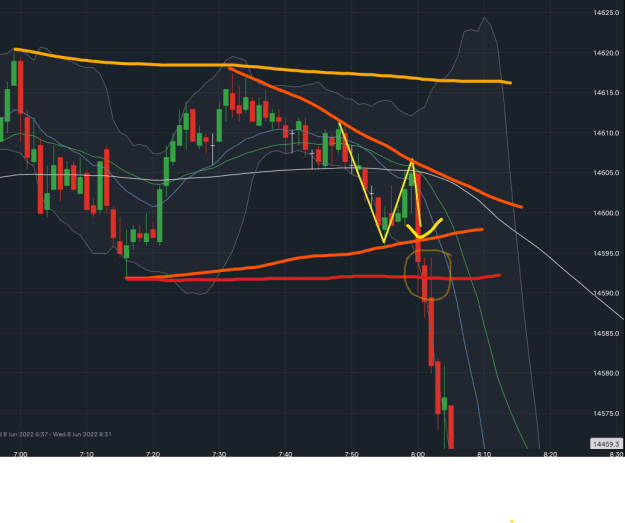

- Post #3,098

- Quote

- Edited 12:36pm Jun 8, 2022 9:09am | Edited 12:36pm

- Joined Aug 2014 | Status: Member | 75,989 Posts

I call upon my father's spirit , watching over me

- Post #3,099

- Quote

- Jun 8, 2022 9:10am Jun 8, 2022 9:10am

- Joined Aug 2014 | Status: Member | 75,989 Posts

I call upon my father's spirit , watching over me

- Post #3,100

- Quote

- Jun 8, 2022 9:14am Jun 8, 2022 9:14am

- Joined Aug 2014 | Status: Member | 75,989 Posts

I call upon my father's spirit , watching over me