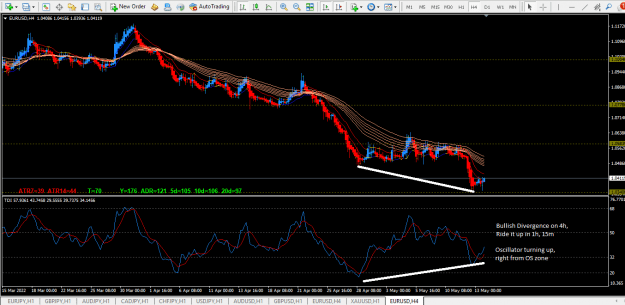

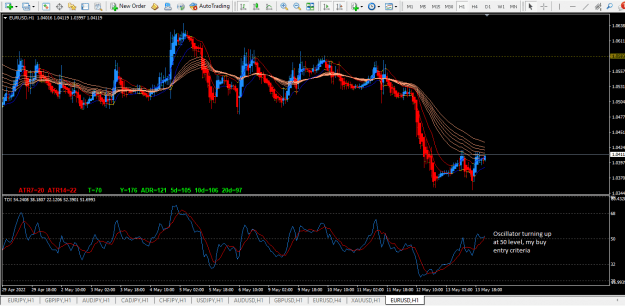

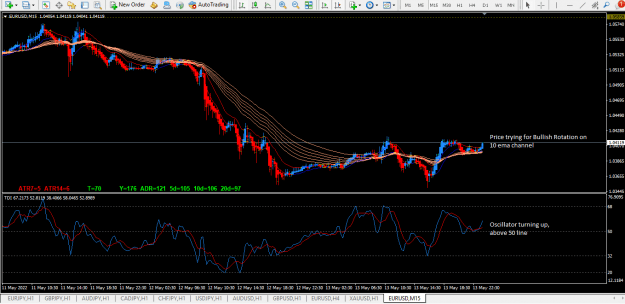

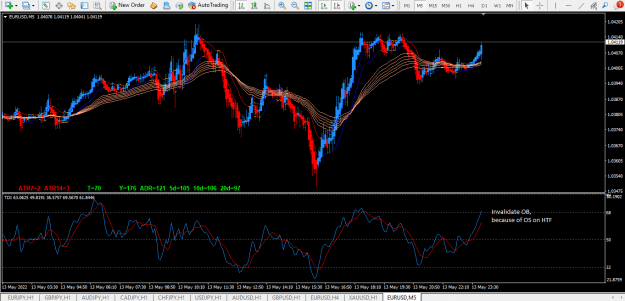

Disliked{quote} Spudfan, Just for your own reasons, I'm waiting for sell set up, on both EJ & GJ. As far as im concerned, market does not have enough momentum to trade 4h swing trades or D positional trades. That is why, Im scalping more since 3 weeks. Take trend on 1h and trade on 15m and 5m towards 1h trend, smaller but regular profits. Small water drops make a mighty ocean, kind. My 2 cents though.Ignored