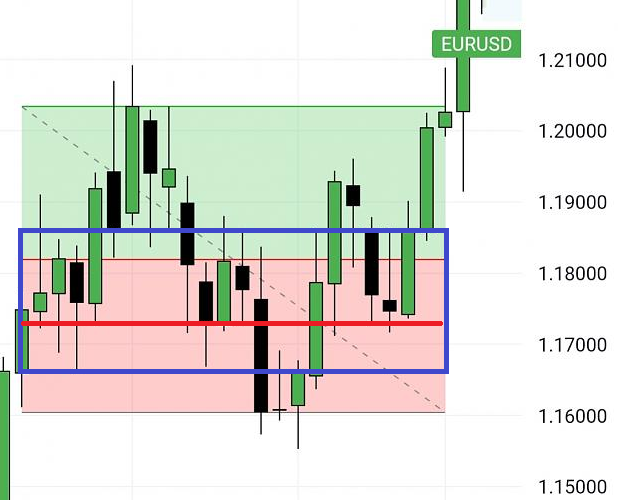

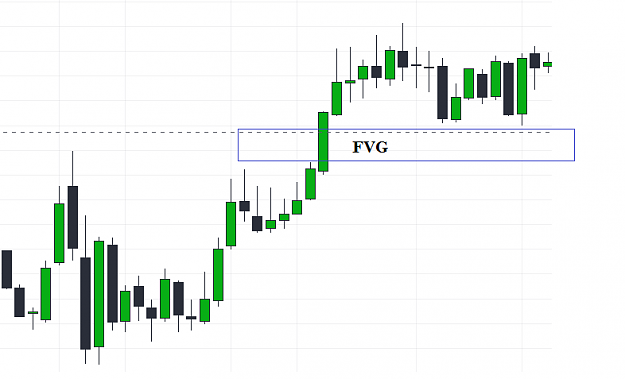

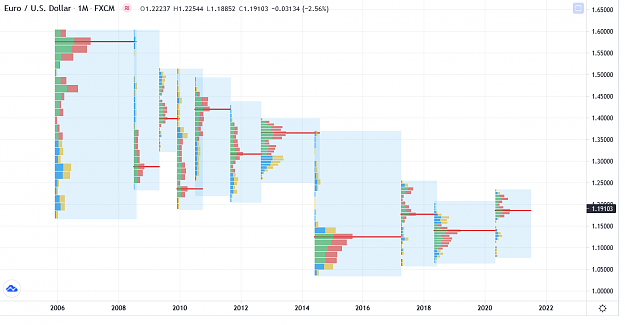

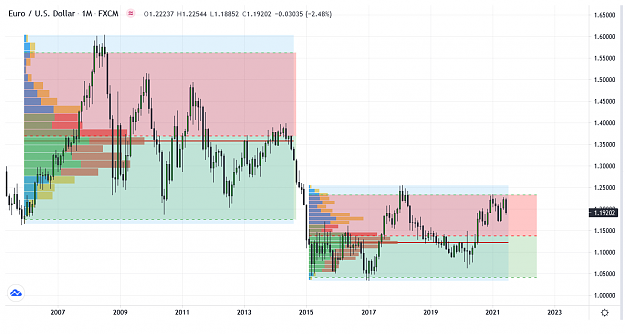

Forex market is decentralized and there is no correct volume for fx traders. I trade futures with volume profile and have been through DoM screening time. I start wondering whether there is way to reverse engineering order flow activities from a naked chart. Balance and imbalance are easy to spot; however, how to find a reasonable value area is harder. If I could get a value area, vpoc is an easy one. It's a s/r inside the value area. Does anyone have some ideas or trade this way?

Quantitative Trader