Disliked{quote} Hey robots4me! In my post I tried to give simple advice to get statistics for every strategy you are going to use no matter EA or manual. What I see with manual trading.... people pick up indicators, see in charts some profitable entries and decide that can go with real money. For example in this thread this recent post. But it must be backtested at least 3 years and only then can decide....Ignored

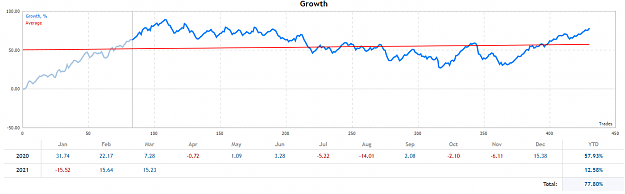

amazing stats!

low drawdown, great profit factor, nice sharpe ratio and a very very good recovery factor + never seen a system with >0.10% APHR GHPR

excellent post! fan of your work.

is this diversified or just one EA?

Let ur winners run & cut ur losses short.

1

1