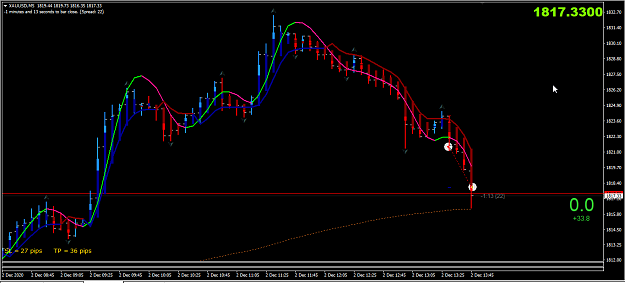

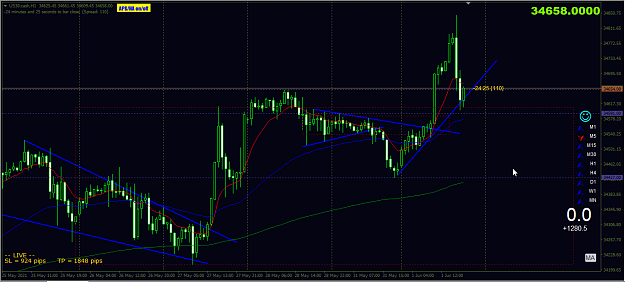

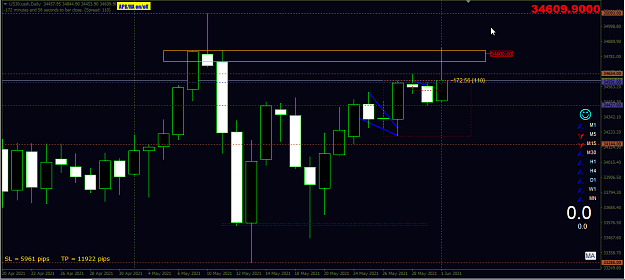

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

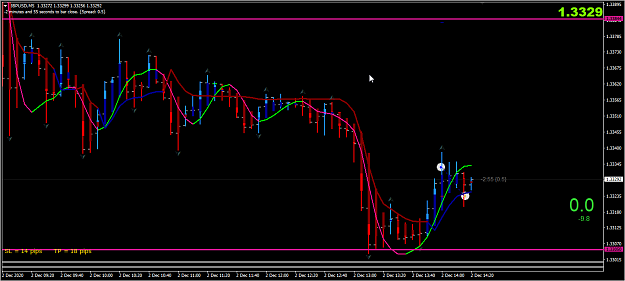

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

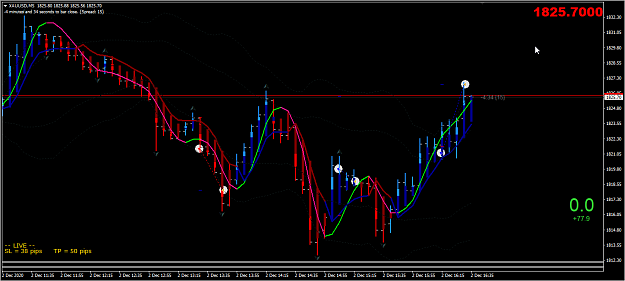

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

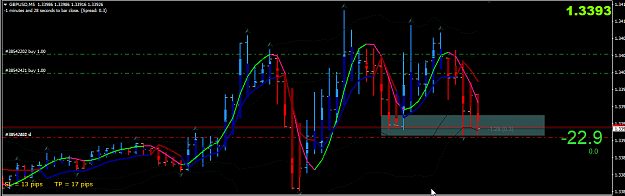

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.

- Joined Jan 2013 | Status: Member | 4,175 Posts

MA provides the market's current direction and strength.