Hello,

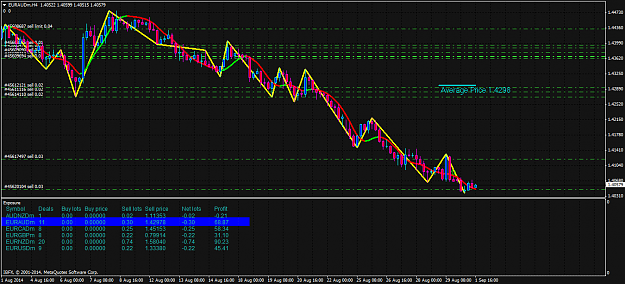

if i open a sellorder at 1.3500 with 0.1 lot and a buyorder at 1.3520 with 0.25 lot, how can i calculate the break even average price for both orders? I know when the price will go more up the win from the buy can be more then the loose from the sell, but how can i calculate the exact price where both orders toghter create 0 win/loos?

if i open a sellorder at 1.3500 with 0.1 lot and a buyorder at 1.3520 with 0.25 lot, how can i calculate the break even average price for both orders? I know when the price will go more up the win from the buy can be more then the loose from the sell, but how can i calculate the exact price where both orders toghter create 0 win/loos?