DislikedNow I haven't read the whole thread, however I know a fair amount about VSA as I used (then abandoned) the concept a few years ago. The big question for me is how the hell do you trade forex using VSA as, particularly for traders using MT4, your Volume is nonsense and doesn't necessarily reflect the entire market, in fact that in itself is probably impossible ? I am happy to be educated...Ignored

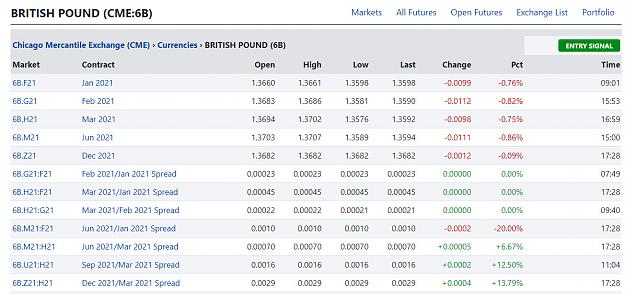

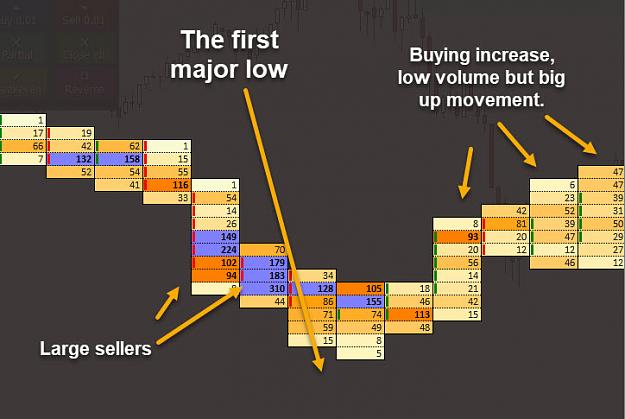

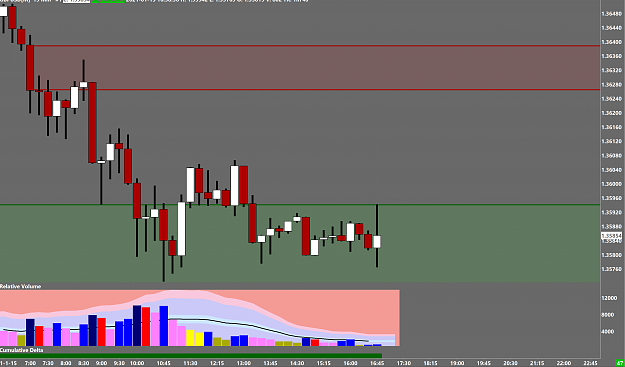

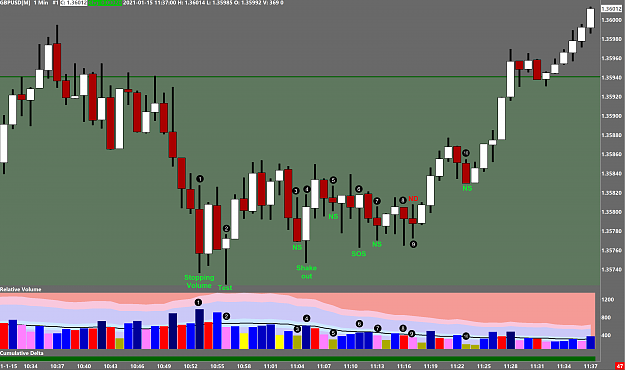

actually I can show you entry points based from VSA from any assets from forex pair, DAX, DOW, GOLD, Bitcoin ... anything from yesterday (friday, 15-01-2021) ... was easy trading day ... but i'm bit lazy to do that. ... lol.

Just read back in the forum ... you will find great great analysis from Malcolmb, HiddenGAP, Anotan and any other great trader in this forum.

Anyway ... there is thousand strategy out there, a simple moving average strategy will work too if you can use it correctly, it hasnt to be VSA .... so if you think that it will not work then find the other one ... ha ha ha ...

the less trader use VSA, the better it is ... we need the crowd ... just kidding lol ....

2