**************************************************************************************************************************

https://ecp.yusercontent.com/mail?ur...M1xToil8_A--~D

Final Call for the Refund Offer

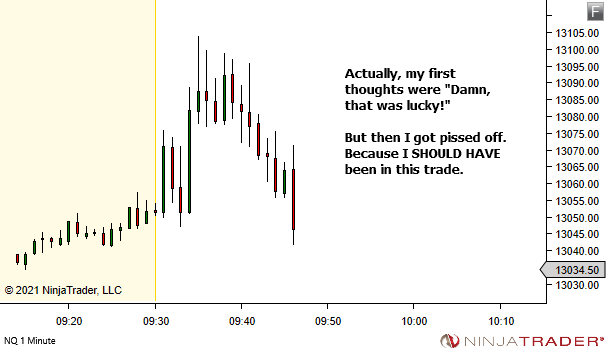

December 2020 was another great month for the MAX Scaping System, with no losing trades! You can go into the New Year with a scalping method that givew you absolute confidence.

This is the last day for the very special New Year's deal, with a $150 refund! That's your bonus for early enrollment, and it disappears at 8 a.m. New York time tomorrow.

This scalping system is...

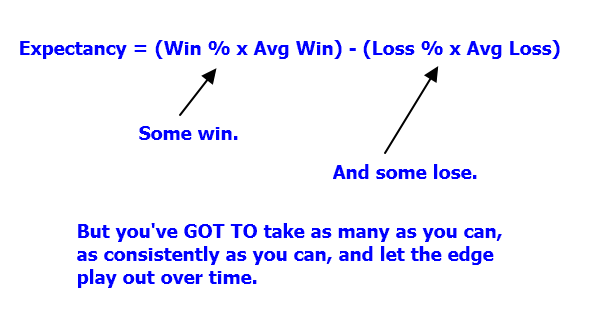

- Extremely reliable with 95% wins

- Providing steady gains

- Two class webinars teach you how to do it

- Great addition to your trend trades

This scalping system is not...

- Providing hi-frequency trading

- Get-rich-quick scheme

There's nothing quite like the feeling of "pulling the trigger" and already knowing your trade is most likely a winner. 95% is truly awesome! You can attend the class webinars or choose to learn entirely by video. With either choice, you get full support and all indicators and templates...no hidden costs!

MAX ETF Scalping Course

Session 1: 14 January, 3:00 p.m. EDT

Session 2: 21 January, 3:00 p.m. EDT

25% New Year's Discount!

$1999 $1499

Enroll before midnight EST on January 7th and receive a $150 refund! Please allow 8 hours for us to process your refund.

Click here to Enroll

If you need monthly payments, a credit card can be used at the above link.

In case you missed our prior MAX Scalping Preview webinar last year, you can watch the playback and learn much more about MAX scalping. Please note that the excellent win rate was maintained throughout the year, and also that US traders are having success with Oanda for scalping. Click Here to Watch

IMPORTANT INFO

This information is critical for all traders.

Brokers

We will leave it up to each individual to choose your own broker for your country's circumstances.It is impossible for us to stay current on what is available or allowed in each country.

The only broker in the USA reasonable for this scalping method is Oanda. Residents of other countries have more options.

Here are questions you should ask any broker you are considering for scalping trades:

1. Do you have a lot of customers to produce good activity/volume on the charts?

A good $ volume would be at least several 100s of millions per day.

This way the tick volume on the charts will be reasonably well correlated to the actual trade volume.

(Unlike the Futures markets, Forex (& MT4) do not display the real contract volume as there is no central exchange.

https://smartforexlearning.com/forex...-shouldnt-use/

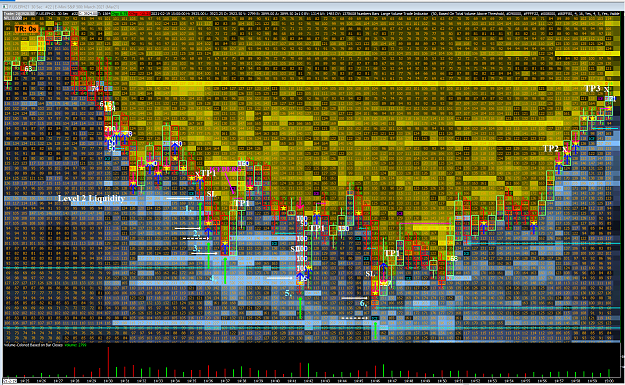

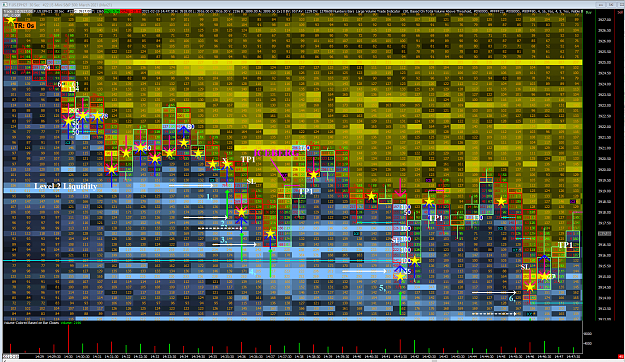

One of the indicators used in the Scalping Course requires a good representation of the volume for accuracy.

2. Is your Trade Execution fast enough for scalping?

We want almost instant execution of trade orders...1 second is too long.

You can check the "Ping" Value in the Account.

Less than 150ms is recommended.

3. What are your Spreads like?

We prefer 1/2 a pip or less.

Items 1 & 2 above are required to minimize potential losses due to small/slow moves.

4. Commissions -- some brokers use commisions instead of spreads, and others charge a commission in addition to the spread..

The commission must be small - no more than the equivalent of a 1/3 of a pip when converted.

Best Times/Markets to use

This scalping method can be used in all sessions,. The Lonson Session and the first 4 hours of the US Session are usually the most productive.

Best Pairs for Scalping

7 Majors + EURGBP (Good spreads & volume)

The following are not good for Scalping on the MT4 Platform:

DAX, Gold, other Indices, CFDs (Unless you are trading future contracts directly on a platform (eg Ninja).

Indicators

All required indicators are included in the course. No additional purchases are required.

Hoping your New Year is having a great start!

The MAX Team

Eusebio, Chris, Craig

****************************************************************************************************