This is NZDUSD.

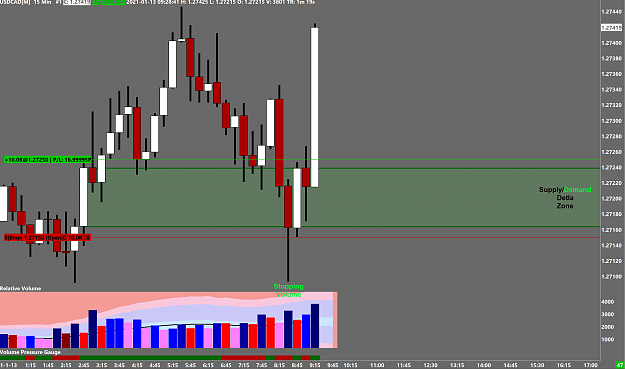

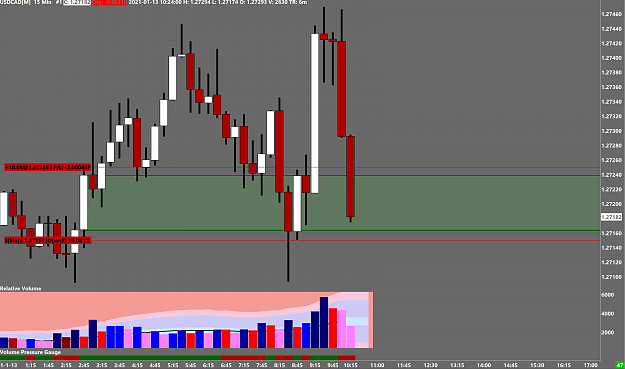

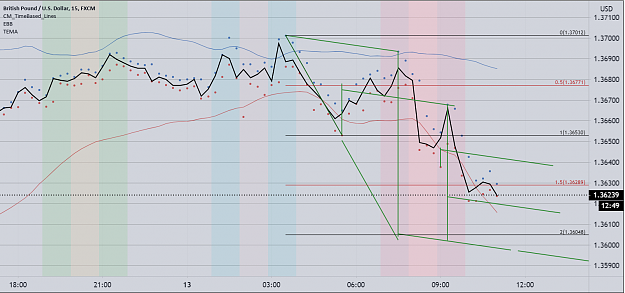

The pink arrow points to a bearish WRB. Price falls away then returns and even exceeds. It reengages then falls through with another WRB (the second pink WRB). Price comes back to the base of the second WRB and it's an easy sell for a 3:1+ trade. Every trade is different but this is a prime example of what look for.

The pink arrow points to a bearish WRB. Price falls away then returns and even exceeds. It reengages then falls through with another WRB (the second pink WRB). Price comes back to the base of the second WRB and it's an easy sell for a 3:1+ trade. Every trade is different but this is a prime example of what look for.

8