Here is my dilemma, probably every traders dilemma. What is the right balance or what is the reasonable balance (lets assume they are the same thing)?

You constantly hear that low risk is the key. Is it, if I want to grow my money and use my money, not just having them in my account, for sake of having lower drawdown and maybe attracting investors ?

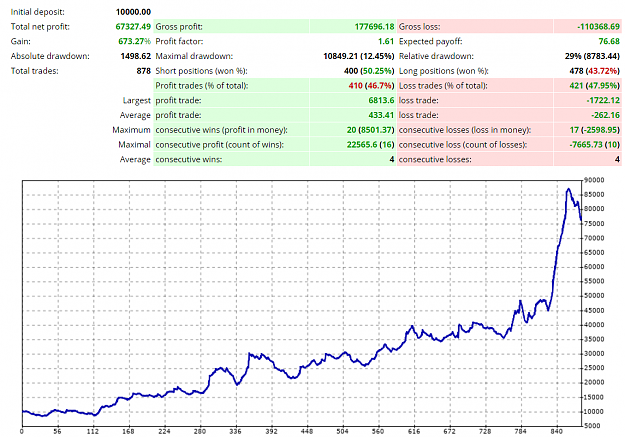

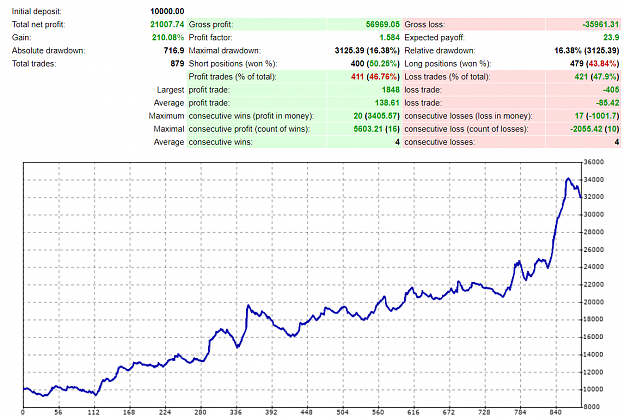

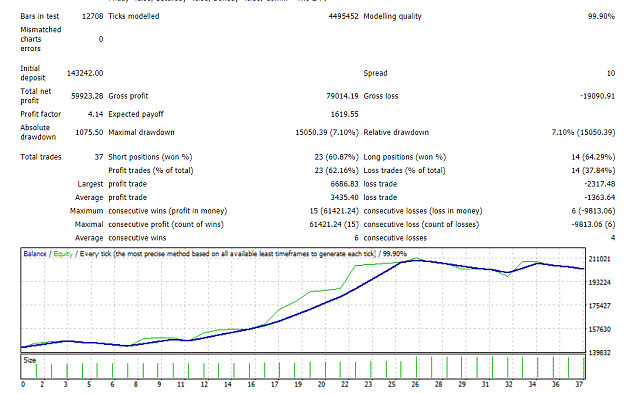

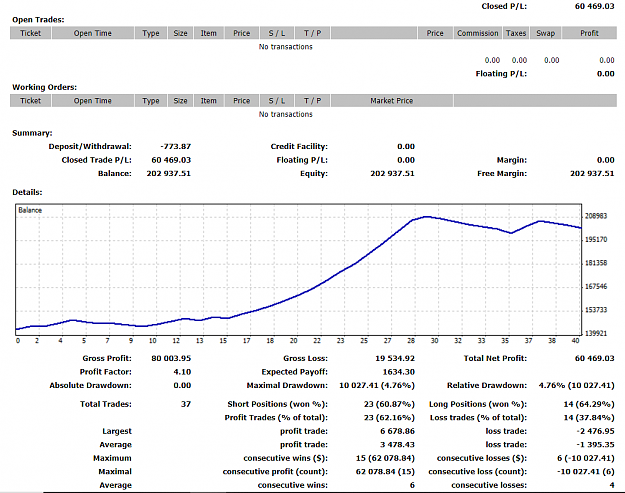

Here is the real life example. It is one good calendar year of my portfolio, with relatively high drawdown and relatively high profit. Rik "x" and risk "x/2".

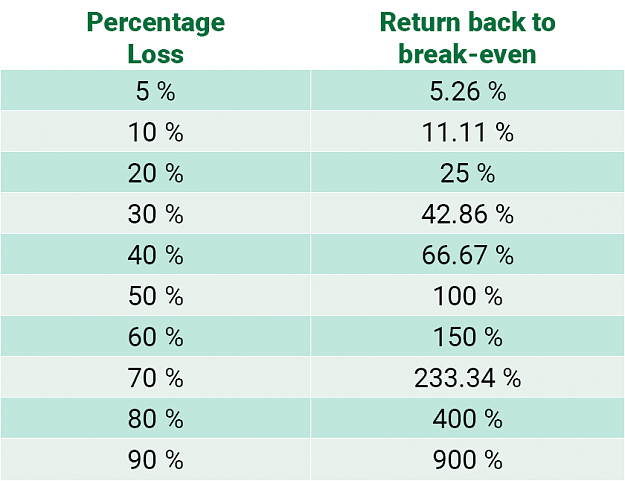

I am using active money management and compounding effect and you can see that there is a big difference in the end of the year. The big problem with low risk is that the profit growth is exponential and the drawdown growth (with higher risk) is linear. In this case 3 times less capital with the higher risk will make the same profit in terms of $ amount. And what you risk, you risk twice as high max drawdown. If you convert this drawdown in to $ amount actually you are risking less money for making the same profit and you can have this money in your bank account for other needs .

What do you think about this?

You constantly hear that low risk is the key. Is it, if I want to grow my money and use my money, not just having them in my account, for sake of having lower drawdown and maybe attracting investors ?

Here is the real life example. It is one good calendar year of my portfolio, with relatively high drawdown and relatively high profit. Rik "x" and risk "x/2".

I am using active money management and compounding effect and you can see that there is a big difference in the end of the year. The big problem with low risk is that the profit growth is exponential and the drawdown growth (with higher risk) is linear. In this case 3 times less capital with the higher risk will make the same profit in terms of $ amount. And what you risk, you risk twice as high max drawdown. If you convert this drawdown in to $ amount actually you are risking less money for making the same profit and you can have this money in your bank account for other needs .

What do you think about this?