Viewing the market through f(x)

100-200MA 1 Hour Time Frame 327 replies

USDJPY pulling back to 200MA 2 replies

Trading 24 hours per day, 5 days per week 14 replies

DislikedMy Story I originally started my trading journey in 2011. Since then, I have been using the technical skills I developed during my career as a software engineer to push the boundaries of what it means to quantitatively analyze the market as a retail trader. After nearly a decade of spending thousands of hours writing algorithms studying the market through the lens of risk-taking and probability, I was finally able to come up with a robust and elegant approach to the market that provided consistent results. Using this approach since 2017, I was able...Ignored

DislikedEURUSD looks to be heading for the stop. Very likely to get stopped out. We are setting up to watch a great development for our next entry though. {image} You can see that we are below the 200 MA and have recently made a nice lower low around 1.2130. We are currently in a pullback heading back towards the MA. We will want to watch here for a new lower high to be formed, and once price starts consolidating around here and turning back down, we will look to short again. You want to picture this playing out before it does, so if/when it does, it's...Ignored

Disliked{quote} Technical Reasons: 1. Above 200MA 2. Possible higher low set at 1.3620 area 3. Price has continued from that low by 33 pips or so (in our 20-40 pips range). Other Reasons: 1. Hedge USD Exposure.Ignored

Disliked{quote} Technical Reasons: 1. Above 200MA 2. Possible higher low set at 1.3620 area 3. Price has continued from that low by 33 pips or so (in our 20-40 pips range). Other Reasons: 1. Hedge USD Exposure.Ignored

Disliked{quote} Much appreciate your posting the live trades instead of after the fact, and the reasoning. Thank you for sharing such a simple & sound strategy.Ignored

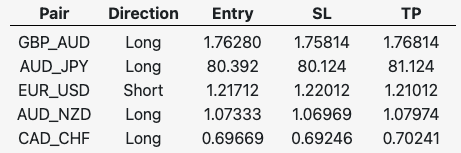

DislikedCurrent Open Trades: {image} Everything is green minus EUR/USD short. That has been consolidating quite a bit. It's still a great short here with a roughly 40% probability of reaching the TP before the SL. You can do the math on the current RR offered by the market to see if that decision makes sense or not.Ignored

Disliked{quote} 22nd Dec ,there's a dangerous reversal PA pattern,sending EURUSD back where it came fromIgnored