Don't post often these days, but when I do, I consider it significant.

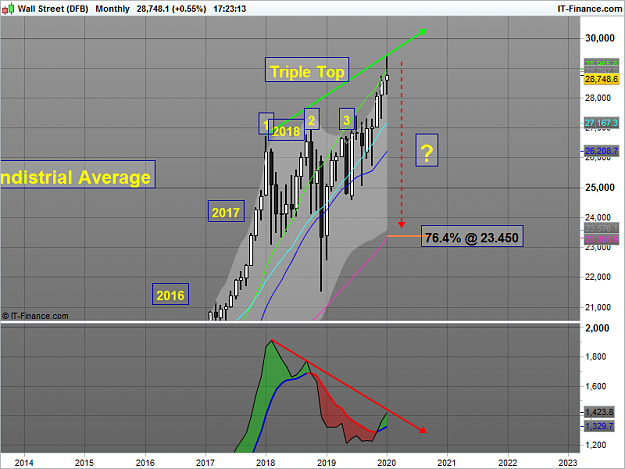

My last post on January 28th https://www.forexfactory.com/thread/...1#post12725611 ( see chart below ) drew attention to the massive diversion pattern on the Dow Jones which I trade, and the rest as they say, is history.

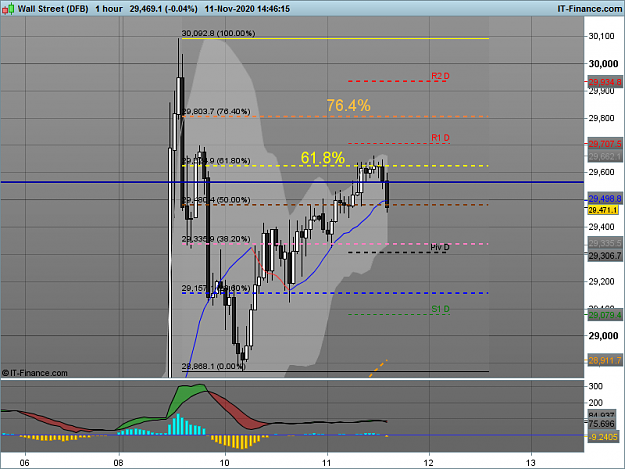

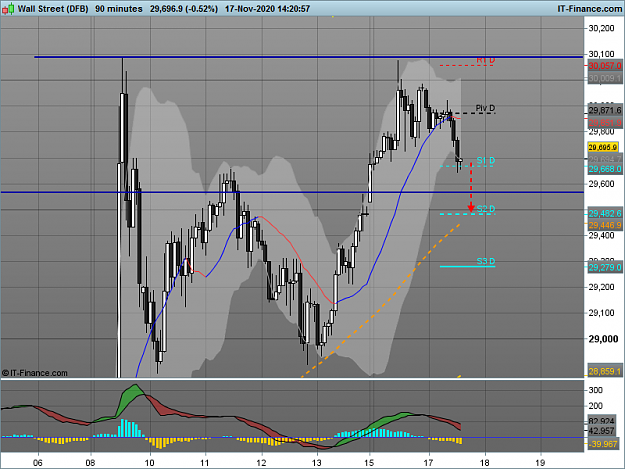

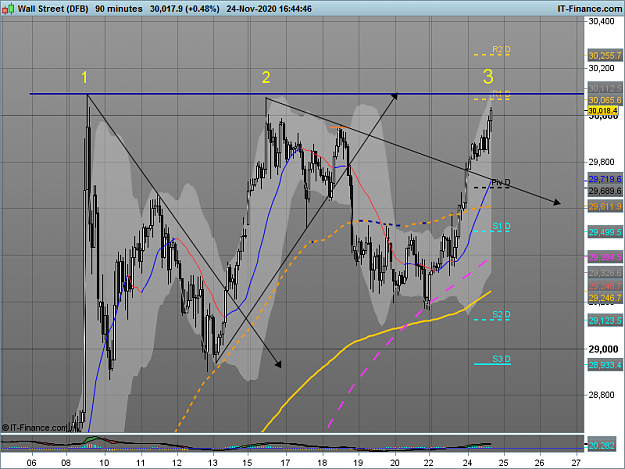

As you all know, the pfizer vaccine news caused unbelievable moves to the upside on all the major global stock markets, and these moves are the reason for today's post.

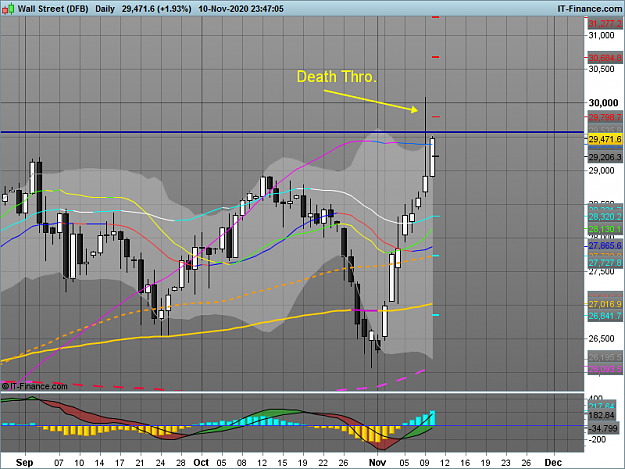

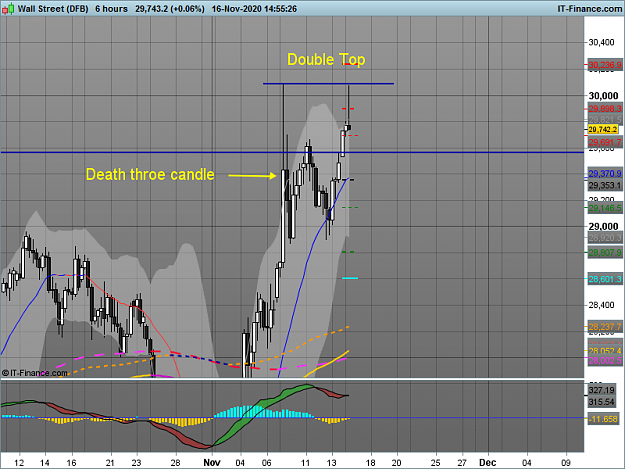

Those who have followed me here on ff during the ten years I have been posting will know of the term ' Death Thro ', which I use to identify sudden, aggressive and exaggerated moves to the upside in an upward trend, though it can be used in bear markets as well. Time and time again, I have seen these moves signal the top or bottom of a market prior to a major reversal.

The daily Dow chart attached here shows all the hallmarks of the death thro - an extended candle closing well below its highs.

Have we just seen the death thro in US stocks? I think we may have.

My last post on January 28th https://www.forexfactory.com/thread/...1#post12725611 ( see chart below ) drew attention to the massive diversion pattern on the Dow Jones which I trade, and the rest as they say, is history.

As you all know, the pfizer vaccine news caused unbelievable moves to the upside on all the major global stock markets, and these moves are the reason for today's post.

Those who have followed me here on ff during the ten years I have been posting will know of the term ' Death Thro ', which I use to identify sudden, aggressive and exaggerated moves to the upside in an upward trend, though it can be used in bear markets as well. Time and time again, I have seen these moves signal the top or bottom of a market prior to a major reversal.

The daily Dow chart attached here shows all the hallmarks of the death thro - an extended candle closing well below its highs.

Have we just seen the death thro in US stocks? I think we may have.