Dislikedim very interested in this but with 676 pages, can anyone give me an idea of what i need to read and download. is there a trading pdf or mt4 adddons + template, or maybe traadingview? anything to help I've set up zones myself before and traded tweezer tops and bottoms and key levels with some success, but the issue i found was consistency.Ignored

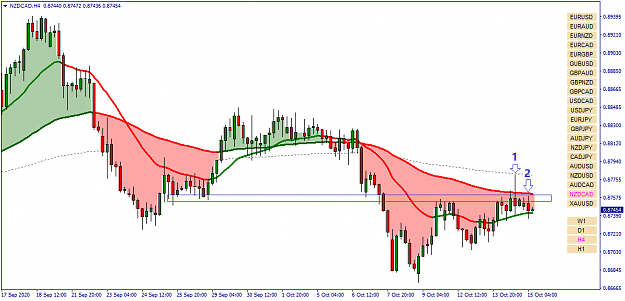

I have yet to reach Consistency. I can just help you with Strat Shadow on tradingview. Here is a post about setting

https://www.forexfactory.com/thread/...0#post13139530

Best regards

Sanji